In the United States, the concept of "us debt stock" refers to the total amount of government debt that is held by the public, including individuals, corporations, and foreign entities. This debt has grown significantly over the years, raising questions about its sustainability and impact on the economy. In this article, we will delve into the key aspects of the US debt stock, its implications, and potential solutions.

The Growth of US Debt Stock

Over the past decade, the US debt stock has surged. According to the U.S. Treasury, the total national debt has exceeded $31 trillion. This staggering figure includes both debt held by the public and intragovernmental holdings. The growth of the debt stock can be attributed to several factors, including increased government spending, tax cuts, and the COVID-19 pandemic.

Implications of the US Debt Stock

The rapid growth of the US debt stock has several implications for the economy and the global financial system.

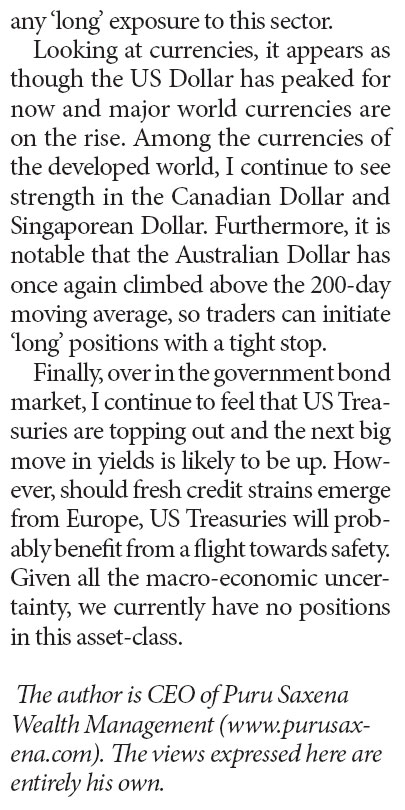

Interest Rates: The growing debt necessitates increased spending on interest payments. This could potentially lead to higher interest rates, which can have a negative impact on the economy.

Currency Value: A significant portion of the US debt is held by foreign entities. If there is a decrease in demand for US dollars, the value of the currency could depreciate, leading to inflationary pressures.

Investment Confidence: If investors believe that the government's debt is unsustainable, they may be reluctant to invest in the US, which could harm economic growth.

Future Generations: The growing debt could potentially burden future generations with the responsibility of repaying it, leading to increased taxes or reduced government spending on essential services.

Potential Solutions

To address the challenges posed by the US debt stock, several solutions have been proposed:

Austerity Measures: Implementing fiscal discipline by reducing government spending and increasing taxes can help reduce the debt burden.

Economic Growth: Promoting economic growth can help generate revenue that can be used to reduce the debt.

Debt Ceiling Changes: Adjusting the debt ceiling to allow for more flexibility in borrowing could help the government manage its debt more effectively.

Structural Reforms: Implementing long-term structural reforms, such as healthcare and pension reforms, can help reduce future spending and improve the sustainability of the debt.

Case Studies

To illustrate the potential impact of the US debt stock, let's consider two case studies:

Greece: In the early 2010s, Greece faced a severe debt crisis. The crisis was caused by a combination of high public debt, economic recession, and mismanagement of public finances. Greece had to undergo austerity measures and a bailout from international lenders to stabilize its economy.

Japan: Japan has one of the highest debt-to-GDP ratios in the world. Despite this, the country has managed to avoid a full-blown debt crisis due to a low interest rate environment and strong export performance.

In conclusion, the US debt stock presents significant challenges and risks to the economy and the global financial system. Addressing these challenges requires a multi-faceted approach, including fiscal discipline, economic growth, and structural reforms. As the situation continues to evolve, it will be important to closely monitor the developments in the US debt stock and consider potential solutions to ensure economic stability and growth.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....