Introduction: In the ever-evolving global financial landscape, U.S. citizens are increasingly exploring investment opportunities beyond their borders. Investing in foreign stocks can be an attractive option for diversifying portfolios and capitalizing on international market trends. However, navigating the complexities of purchasing foreign stocks requires careful consideration and understanding of the associated regulations and risks. In this article, we will delve into the key aspects of investing in foreign stocks for U.S. citizens, providing a comprehensive guide to help you make informed decisions.

Understanding Foreign Stocks: Foreign stocks refer to shares of companies listed on exchanges outside of the United States. These stocks can be from companies in various countries, such as Canada, the United Kingdom, Japan, China, and more. Investing in foreign stocks allows U.S. citizens to tap into different markets and potentially benefit from diverse economic growth and currency movements.

Key Considerations for U.S. Citizens Purchasing Foreign Stocks:

Tax Implications: It is crucial for U.S. citizens to understand the tax implications of investing in foreign stocks. While U.S. citizens are subject to U.S. tax laws on their worldwide income, there are specific rules and reporting requirements for foreign investments. The Foreign Account Tax Compliance Act (FATCA) and the Report of Foreign Bank and Financial Accounts (FBAR) are key regulations to be aware of.

Exchange Rate Fluctuations: Investing in foreign stocks exposes investors to currency risk. Fluctuations in exchange rates can impact the value of your investment in U.S. dollars. It is important to consider the potential volatility and plan accordingly.

Regulatory Compliance: U.S. citizens investing in foreign stocks must comply with various regulations, including the requirement to file the Form 8938 if the value of their foreign financial assets exceeds certain thresholds. Failure to comply with these regulations can result in penalties and fines.

Research and Due Diligence: Conduct thorough research and due diligence before investing in foreign stocks. Evaluate the financial health, business model, and growth prospects of the companies you are considering. Additionally, consider the political and economic stability of the country where the company is based.

Diversification Benefits: Investing in foreign stocks can provide diversification benefits to your portfolio. Different markets may react differently to economic events, reducing the overall risk of your investment portfolio.

Case Study: Investing in Japanese Stocks

Let's consider a hypothetical scenario where a U.S. citizen decides to invest in Japanese stocks. By diversifying their portfolio with Japanese stocks, the investor aims to benefit from the strong technology sector in Japan. However, they must be mindful of the potential risks, such as currency fluctuations and political instability in the region.

To mitigate these risks, the investor conducts thorough research on Japanese companies, evaluates their financial statements, and stays updated on economic and political developments in Japan. They also consider using hedging strategies to protect against currency fluctuations.

Conclusion: Investing in foreign stocks can offer numerous benefits for U.S. citizens, including diversification and potential for higher returns. However, it is crucial to understand the associated risks and regulations. By conducting thorough research, considering tax implications, and staying informed about global market trends, U.S. citizens can make informed decisions when purchasing foreign stocks.

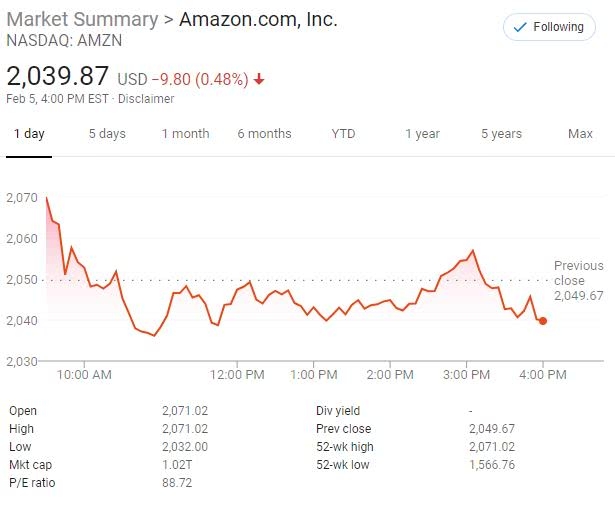

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....