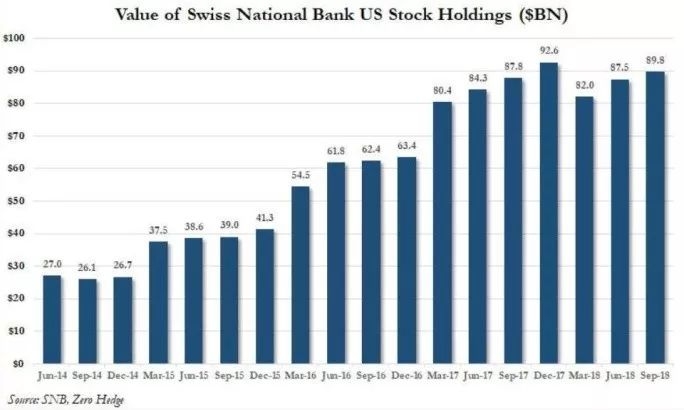

In a bold move that has caught the attention of global investors, the Swiss National Bank (SNB) has recently announced its intent to purchase US stocks. This strategic investment is not only a testament to the SNB's confidence in the US economy but also a significant shift in its investment strategy. In this article, we delve into the reasons behind this decision, its potential implications, and the broader implications for the global financial landscape.

Why the Swiss National Bank is Investing in US Stocks

The SNB's decision to buy US stocks is primarily driven by several factors. Firstly, the SNB is looking to diversify its investment portfolio, which has traditionally been heavily focused on Swiss franc assets. By investing in US stocks, the SNB aims to reduce its exposure to the Swiss franc and potentially benefit from the stronger US dollar.

Secondly, the SNB is likely influenced by the robust economic performance of the United States. The US economy has shown resilience in recent years, with strong growth, low unemployment, and a favorable business environment. This has made US stocks an attractive investment option for the SNB.

Potential Implications of the SNB's Investment

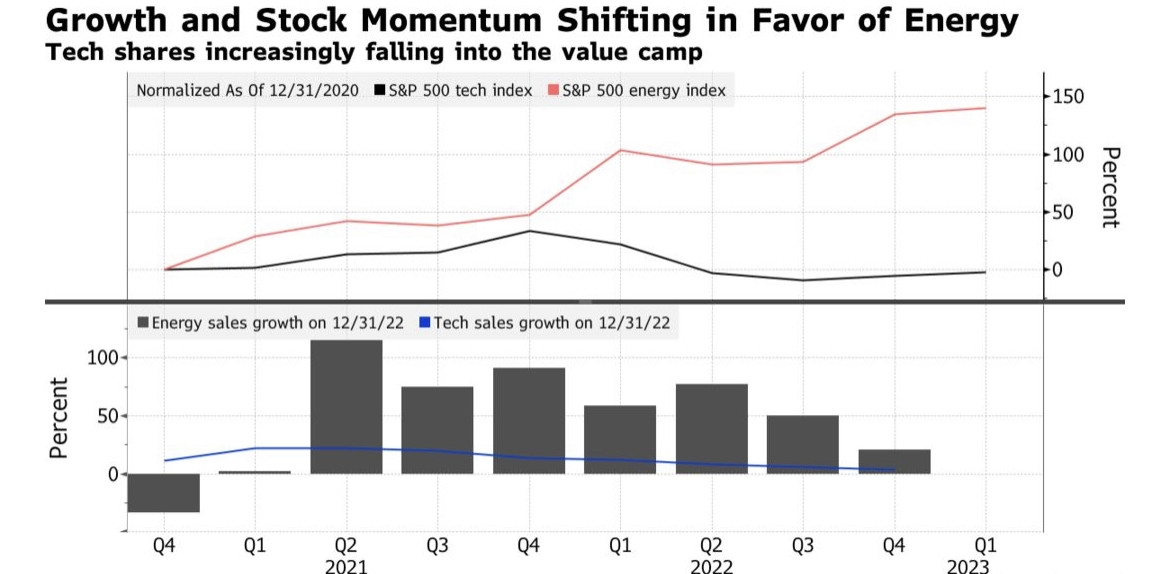

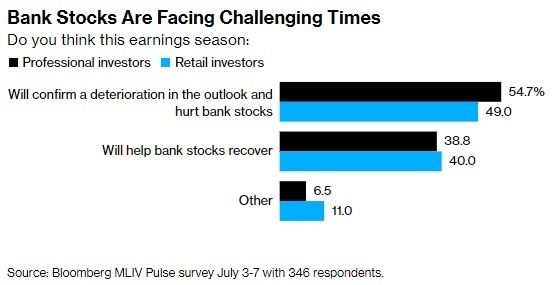

The SNB's investment in US stocks could have several implications for the global financial landscape. Firstly, it could lead to increased demand for US stocks, potentially driving up their prices. This could benefit US companies and investors, but it may also lead to increased volatility in the stock market.

Secondly, the SNB's investment could have a ripple effect on other central banks. Other central banks may feel compelled to follow suit and invest in US stocks, further driving up demand and potentially leading to a global investment boom.

A Closer Look at the SNB's Investment Strategy

The SNB's investment strategy is particularly interesting given its size and the fact that it is a central bank. The SNB has a mandate to ensure price stability in Switzerland, and its investment decisions are typically made with this goal in mind. However, the decision to invest in US stocks suggests a shift in the SNB's approach to investment.

One possible explanation for this shift is the SNB's recognition of the global nature of the financial markets. In today's interconnected world, the SNB understands that its investment decisions can have a significant impact on the global financial landscape. By investing in US stocks, the SNB is effectively taking a more global perspective on its investment strategy.

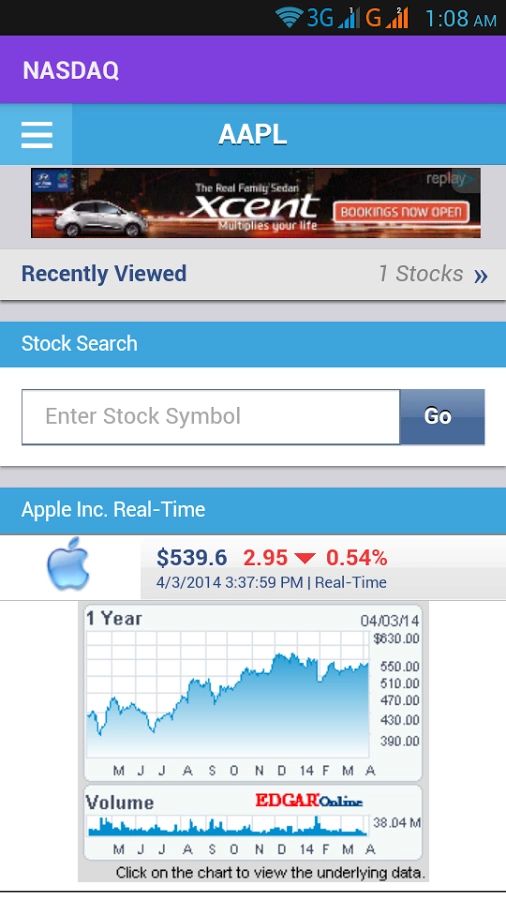

Case Study: SNB's Investment in Apple Inc.

One of the notable investments made by the SNB is in Apple Inc., one of the largest and most influential companies in the world. This investment highlights the SNB's focus on high-quality, blue-chip stocks. By investing in Apple, the SNB is likely aiming to benefit from the company's strong financial performance and potential for future growth.

Conclusion

The Swiss National Bank's decision to buy US stocks is a significant development that could have far-reaching implications for the global financial landscape. By diversifying its investment portfolio and investing in high-quality US stocks, the SNB is taking a proactive approach to managing its assets. As the world watches, it will be interesting to see how this decision impacts the global financial markets and the SNB's investment strategy in the future.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....