The financial market is a dynamic landscape, and the recent plunge in US bank stocks has left many investors scratching their heads. In this article, we delve into the reasons behind the sudden downturn and what it means for the broader economy.

Reasons for the Decline

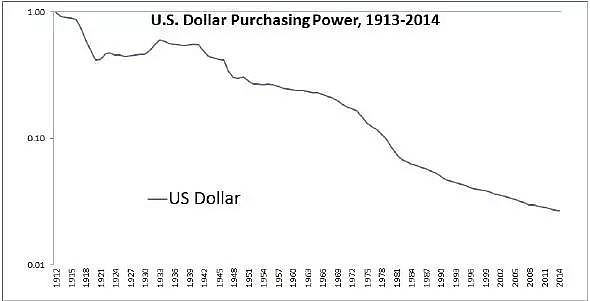

Economic Concerns: The global economic climate has been a significant factor contributing to the decline. Concerns over inflation, rising interest rates, and a potential recession have cast a shadow over the banking sector.

Regulatory Scrutiny: The banking industry has been under increased regulatory scrutiny, with several high-profile cases of misconduct and fraud. This has eroded investor confidence and led to a sell-off in bank stocks.

Tech Disruption: The rise of fintech companies has posed a significant threat to traditional banks. These digital platforms offer more convenient and cost-effective banking services, leading to a shift in consumer behavior.

Impact on the Broader Economy

The decline in US bank stocks has broader implications for the economy. Banks play a crucial role in the financial system, providing loans, investment services, and other financial products. A weaker banking sector can lead to a credit crunch, affecting businesses and consumers alike.

Case Studies

JPMorgan Chase: One of the most significant banks in the US, JPMorgan Chase, has seen its stock price plummet by nearly 20% in the past year. This decline can be attributed to the aforementioned factors, including economic concerns and regulatory scrutiny.

Bank of America: Another major bank, Bank of America, has also experienced a significant drop in its stock price. The bank has been under investigation for its role in the 2008 financial crisis and subsequent misconduct.

What Investors Should Do

If you are an investor with exposure to US bank stocks, it is essential to stay informed and adapt your strategy accordingly. Here are some tips:

Diversify Your Portfolio: Diversification can help mitigate the risk associated with a concentrated exposure to any single stock or sector.

Stay Informed: Keep up with the latest news and developments in the banking industry to make informed decisions.

Seek Professional Advice: Consider consulting with a financial advisor to help navigate the complexities of the market.

The recent plunge in US bank stocks is a wake-up call for investors and regulators alike. As the economy continues to evolve, it is crucial to stay informed and adapt to the changing landscape.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....