In today's fast-paced financial landscape, building self-wealth is a crucial goal for many Americans. One of the most effective ways to achieve this is through investing in U.S. stocks. This article explores the benefits of investing in U.S. stocks and provides valuable insights to help you maximize your self-wealth.

Understanding U.S. Stocks

Firstly, it's important to understand what U.S. stocks are. A stock represents a share of ownership in a company. When you buy a stock, you are essentially purchasing a small piece of that company. U.S. stocks are traded on major exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

The Benefits of Investing in U.S. Stocks

Potential for High Returns: One of the primary reasons people invest in stocks is the potential for high returns. Over the long term, the stock market has historically provided higher returns than other investment vehicles like bonds or savings accounts.

Diversification: Investing in a variety of U.S. stocks can help reduce your risk. By diversifying your portfolio, you can minimize the impact of any single stock's performance on your overall investment returns.

Inflation Protection: Stocks tend to outpace inflation over the long term. This means that your investment can grow in value while keeping pace with rising prices.

Tax Advantages: U.S. stocks offer several tax advantages, including capital gains tax rates that are often lower than income tax rates. Additionally, dividends received from U.S. stocks are typically taxed at a lower rate than ordinary income.

How to Invest in U.S. Stocks

Research and Education: Before investing in U.S. stocks, it's important to research and educate yourself about the market. This includes understanding different stock types, market trends, and investment strategies.

Choose the Right Brokerage: Select a reputable brokerage firm that offers a user-friendly platform and low fees. Some popular options include Charles Schwab, Fidelity, and TD Ameritrade.

Develop an Investment Strategy: Determine your investment goals, risk tolerance, and time horizon. This will help you choose the right stocks and investment vehicles for your portfolio.

Stay Disciplined: Investing in stocks requires discipline and patience. Avoid making impulsive decisions based on short-term market fluctuations.

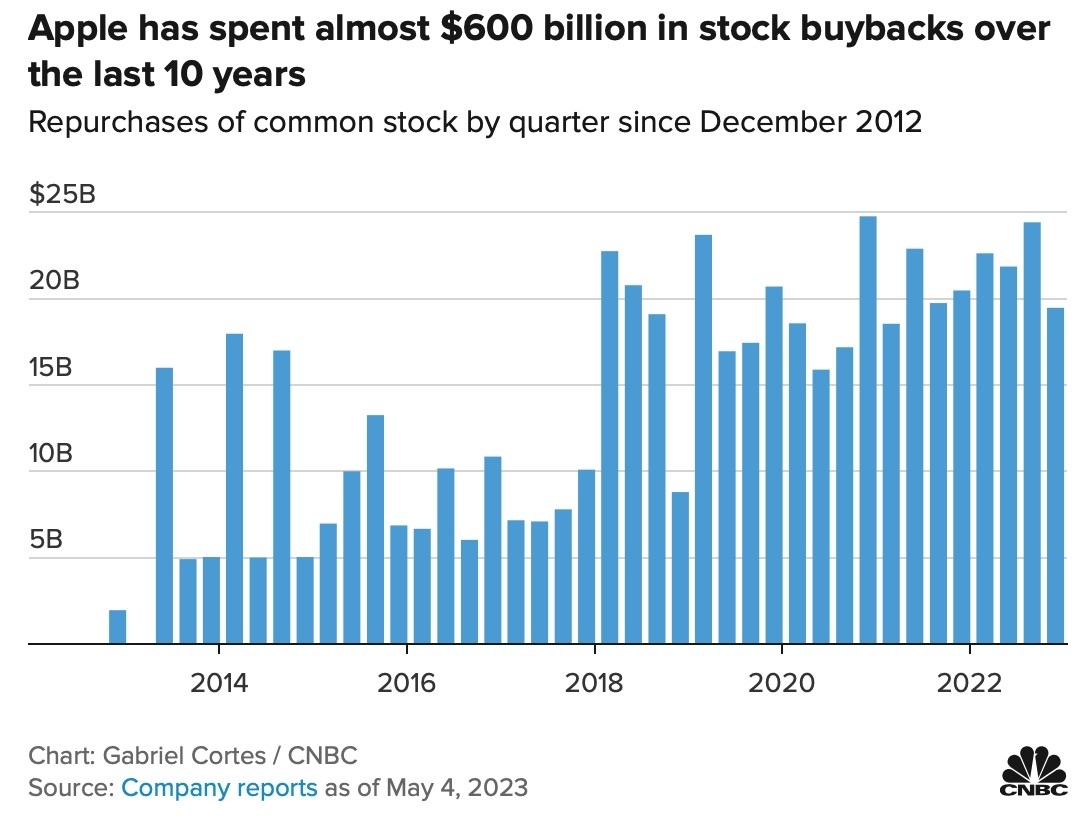

Case Study: Apple Inc.

One of the most successful U.S. stocks is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown into one of the world's most valuable companies. By investing in Apple stock, investors have seen significant returns over the years. For example, if you had invested

Conclusion

Investing in U.S. stocks can be a powerful tool for building self-wealth. By understanding the benefits and risks, conducting thorough research, and developing a disciplined investment strategy, you can maximize your returns and achieve your financial goals. Remember, investing in stocks requires patience and discipline, but the potential rewards can be substantial.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....