In the ever-evolving financial landscape of the United States, investors are often faced with the age-old question: "Real estate or stocks?" Both sectors offer unique opportunities and risks, making the decision a significant one. This article delves into the key factors that differentiate real estate from stocks, providing a comprehensive guide for investors looking to diversify their portfolios.

Understanding Real Estate

Real estate investment involves purchasing properties such as houses, apartments, and commercial buildings. It is a tangible asset that can generate income through rent, capital appreciation, and leverage. Here are some key points to consider:

- Income Generation: Real estate can provide a steady stream of income through rental payments. This makes it an attractive option for investors looking for a reliable source of cash flow.

- Leverage: Investors can leverage their investments by using mortgages to finance property purchases. This means they can control a larger asset with a smaller upfront investment.

- Capital Appreciation: Over time, real estate properties can appreciate in value, providing investors with a significant return on investment.

- Tax Advantages: Real estate investments offer various tax benefits, such as depreciation deductions and capital gains tax deferrals.

Understanding Stocks

Stocks represent ownership in a company. When you buy stocks, you are essentially buying a small piece of that company. Here are some key points to consider:

- Potential for High Returns: Stocks have historically offered higher returns than real estate, especially over the long term. This is due to the potential for dividends and capital gains.

- Liquidity: Stocks are highly liquid, meaning they can be bought and sold quickly without significantly impacting their price.

- Diversification: Investing in stocks allows investors to diversify their portfolios, reducing risk.

- Inflation Protection: Stocks tend to outpace inflation over the long term, making them a good hedge against rising prices.

Comparing Real Estate and Stocks

When comparing real estate and stocks, it's important to consider several factors:

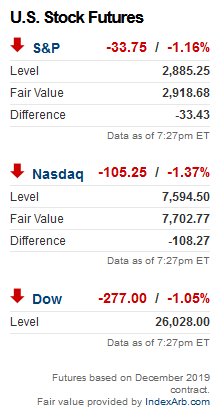

- Risk: Real estate investments are generally considered less risky than stocks due to their tangible nature and income-generating potential. However, they are subject to market fluctuations and property values can decline.

- Liquidity: Stocks are more liquid than real estate, making them easier to sell quickly if needed.

- Time and Effort: Real estate investments require more time and effort to manage, especially when it comes to finding tenants and maintaining properties.

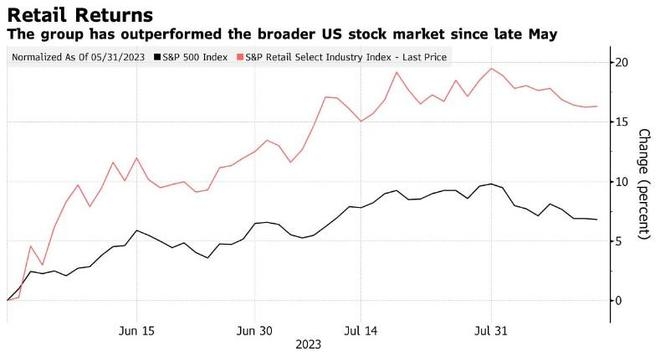

- Market Performance: Over the long term, stocks have historically outperformed real estate. However, real estate can provide a more stable investment during economic downturns.

Case Studies

To illustrate the differences between real estate and stocks, consider the following case studies:

- Real Estate: An investor purchases a rental property for

200,000 and finances it with a 20% down payment. After five years, the property is worth 250,000, and the investor has collected $20,000 in rental income. This provides a return on investment of 15%. - Stocks: An investor purchases $200,000 worth of stocks and earns a 10% return over five years. This provides a return on investment of 10%.

Conclusion

When deciding between real estate and stocks, investors must consider their financial goals, risk tolerance, and investment horizon. Both sectors offer unique advantages and disadvantages, making it essential to do thorough research and consult with a financial advisor before making a decision.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....