In the world of finance, the relationship between interest rates and the stock market is a topic that has intrigued investors for decades. The Federal Reserve's decisions on interest rates can have a profound impact on the stock market, making it crucial for investors to understand this dynamic. This article delves into the intricate relationship between US interest rates and the stock market, highlighting key factors and providing real-world examples.

Understanding the Impact of Interest Rates on the Stock Market

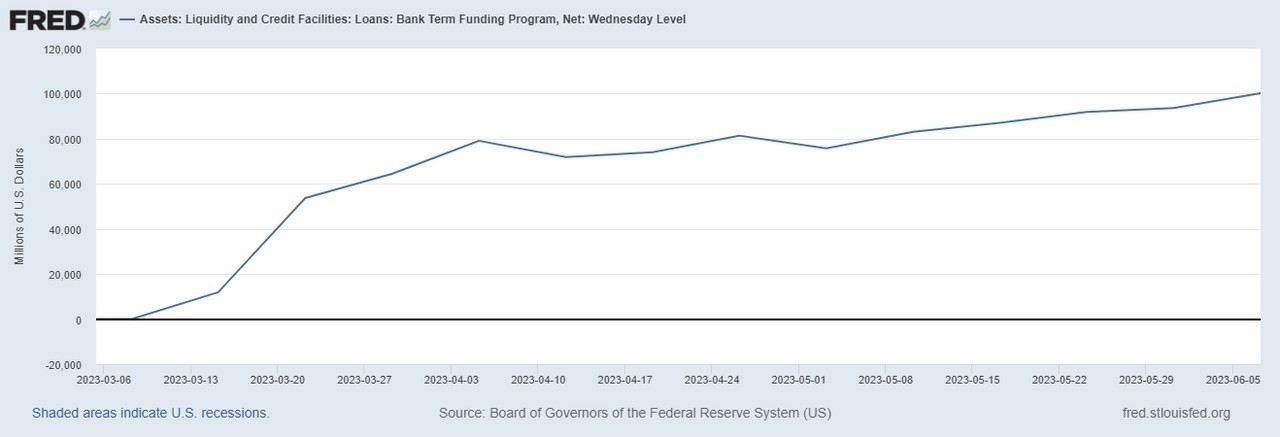

Interest rates are a key tool used by the Federal Reserve to control the economy. When the Fed raises interest rates, borrowing becomes more expensive, which can slow down economic growth. Conversely, when the Fed lowers interest rates, borrowing becomes cheaper, encouraging businesses and consumers to spend and invest more.

The Effect of Rising Interest Rates on the Stock Market

Historically, when the Federal Reserve raises interest rates, the stock market tends to suffer. This is because higher interest rates can lead to several negative effects:

- Increased Borrowing Costs: Higher interest rates make it more expensive for companies to borrow money for expansion, which can reduce their profitability.

- Lower Stock Valuations: As interest rates rise, the present value of future earnings decreases, leading to lower stock valuations.

- Reduced Consumer Spending: Higher interest rates can lead to higher borrowing costs for consumers, which can reduce their spending on goods and services, negatively impacting corporate earnings.

For example, in 2018, when the Federal Reserve raised interest rates four times, the stock market experienced a significant downturn. The S&P 500, a widely followed index of large US companies, fell by nearly 6% during that period.

The Effect of Falling Interest Rates on the Stock Market

Conversely, when the Federal Reserve lowers interest rates, the stock market often benefits. Lower interest rates can lead to several positive effects:

- Reduced Borrowing Costs: Lower interest rates make it cheaper for companies to borrow money for expansion, which can boost their profitability.

- Higher Stock Valuations: As interest rates fall, the present value of future earnings increases, leading to higher stock valuations.

- Increased Consumer Spending: Lower interest rates can lead to lower borrowing costs for consumers, which can increase their spending on goods and services, positively impacting corporate earnings.

For instance, in 2019, when the Federal Reserve cut interest rates three times, the stock market experienced a significant rally. The S&P 500 rose by nearly 29% during that period.

Key Factors to Consider

Several factors can influence the relationship between interest rates and the stock market, including:

- Economic Conditions: The overall economic environment, such as GDP growth, unemployment, and inflation, can impact the Federal Reserve's decisions on interest rates and, consequently, the stock market.

- Market Sentiment: Investor sentiment can play a significant role in how the stock market responds to changes in interest rates.

- Earnings Reports: Companies' earnings reports can provide insights into their financial health and outlook, which can influence the stock market's response to interest rate changes.

Conclusion

Understanding the relationship between US interest rates and the stock market is essential for investors looking to make informed decisions. While higher interest rates can lead to a downturn in the stock market, lower interest rates can result in a rally. By keeping a close eye on economic indicators, market sentiment, and company earnings reports, investors can better navigate the dynamic relationship between interest rates and the stock market.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....