Introduction

The US stock market has long been a beacon of economic growth and opportunity. However, like any investment market, it's not immune to downturns. If you're looking to hedge your bets or simply capitalize on market volatility, betting against the US stock market might be a viable strategy. In this article, we'll explore various methods to help you navigate this complex landscape.

Understanding the Risks

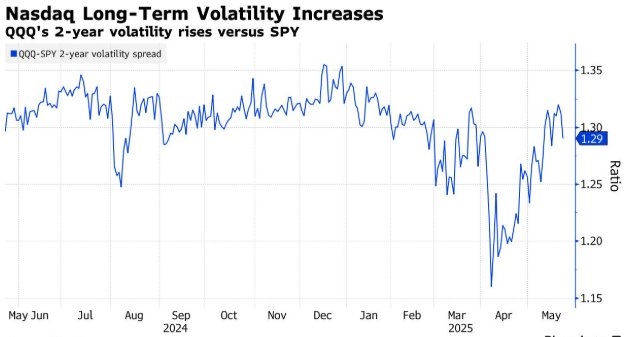

Before diving into the strategies, it's crucial to understand the risks involved. Betting against the stock market can be risky, and it's essential to have a solid understanding of the market dynamics. Volatility is a significant factor, and market sentiment can shift rapidly. It's also important to note that short-selling can be expensive and requires a margin account.

1. Short Selling

Short selling is one of the most common ways to bet against the stock market. It involves borrowing shares from a broker and selling them at the current market price. The goal is to buy back the shares at a lower price in the future, returning them to the broker, and pocketing the difference.

Example: Let's say you believe a particular company, XYZ Corp., is overvalued. You borrow 100 shares of XYZ Corp. at

2. Put Options

Another way to bet against the stock market is by purchasing put options. A put option gives you the right, but not the obligation, to sell a stock at a predetermined price within a specific time frame.

Example: If you think the stock market will decline, you can purchase a put option on a broad market index, like the S&P 500. If the index falls, the value of your put option will increase, allowing you to sell the option at a profit.

3. Inverse ETFs

Inverse ETFs (Exchange-Traded Funds) are designed to move in the opposite direction of a particular index, such as the S&P 500. These funds can be a convenient way to bet against the stock market without engaging in short selling or options trading.

Example: An inverse ETF with a 2x leverage will move twice as much as the underlying index. If the S&P 500 falls by 1%, the inverse ETF will rise by 2%.

4. Leveraged Bear ETFs

Leveraged bear ETFs are similar to inverse ETFs but offer higher leverage. These funds aim to provide double or triple the inverse performance of the underlying index.

Example: A 3x leveraged bear ETF will move three times as much as the index. If the S&P 500 falls by 1%, the leveraged bear ETF will rise by 3%.

Conclusion

Betting against the US stock market can be a challenging endeavor, but it's not impossible. By understanding the risks and utilizing various strategies, such as short selling, put options, inverse ETFs, and leveraged bear ETFs, you can position yourself to capitalize on market downturns. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....