Are you looking to expand your investment portfolio and include Japanese stocks? With the rise of globalization, investing in international markets has become more accessible than ever. Japan, being the world's third-largest economy, offers a plethora of investment opportunities. If you are based in the United States and want to invest in Japanese stocks, this guide will provide you with all the essential information you need to get started.

Understanding Japanese Stock Market

The Japanese stock market, also known as the Tokyo Stock Exchange (TSE), is one of the largest and most liquid in the world. It is home to numerous multinational corporations, and investing in Japanese stocks can offer diversification and potential growth opportunities for your portfolio.

Steps to Invest in Japanese Stocks from the US

1. Choose a Broker

The first step to investing in Japanese stocks from the US is to open an account with a brokerage firm that offers access to the Japanese market. Some popular brokers include Interactive Brokers, Charles Schwab, and TD Ameritrade. Make sure to research and compare fees, minimum investment requirements, and customer service before choosing a broker.

Key Consideration: Look for brokers that provide low fees, a user-friendly platform, and access to a wide range of Japanese stocks.

2. Learn About Japanese Financial Markets

Before investing, it is crucial to understand the unique aspects of the Japanese stock market. The market operates on a different time zone and trading hours, and Japanese companies may have different reporting standards. Familiarize yourself with the market structure, stock symbols, and trading conventions.

Key Takeaways: Study the different sectors and industries within the Japanese market to identify potential investment opportunities.

3. Fund Your Brokerage Account

Once you have chosen a broker, fund your account to begin trading. You can transfer funds from your bank account or use other funding methods provided by the broker.

Important Note: Ensure that you have enough capital to cover your investment objectives and risk tolerance.

4. Research Japanese Stocks

Before making any investment decisions, conduct thorough research on the Japanese stocks you are interested in. Analyze financial statements, historical performance, and other relevant factors. Consider using tools and resources provided by your broker to streamline the research process.

Case Study: Invest in companies like Toyota, Sony, or Nintendo, which are well-known global brands with a strong presence in the Japanese stock market.

5. Place Your Order

Once you have identified a stock you want to invest in, place your order through your brokerage account. You can choose to buy shares of a Japanese stock using a market order, which executes at the current market price, or a limit order, which allows you to specify a maximum price you are willing to pay.

Key Tip: Keep an eye on the market's volatility and be prepared to execute your order promptly.

Conclusion

Investing in Japanese stocks from the US can be a rewarding experience if done correctly. By following these steps, you can navigate the Japanese stock market and add valuable assets to your investment portfolio. Remember to conduct thorough research, choose a reliable broker, and manage your risks effectively. Happy investing!

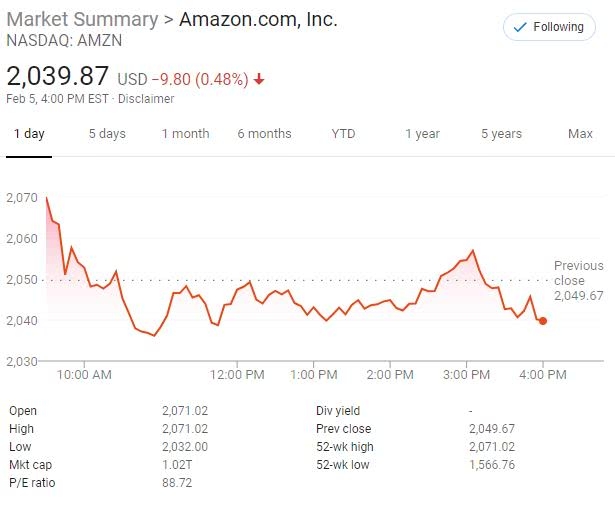

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....