The upcoming elections in the United States have sparked a great deal of speculation about the potential impact on the stock market. With Democrats looking to make significant gains, many investors are wondering how a Democratic win could affect U.S. stocks. In this article, we'll delve into the potential effects of a Democratic win on the stock market, examining various factors and historical trends.

Understanding the Political Landscape

First and foremost, it's important to understand that a Democratic win in the upcoming elections doesn't necessarily mean a sweeping victory for the party. Instead, it's more likely to result in a divided government, with the Democrats controlling the House of Representatives while the Republicans retain control of the Senate.

Potential Policy Changes

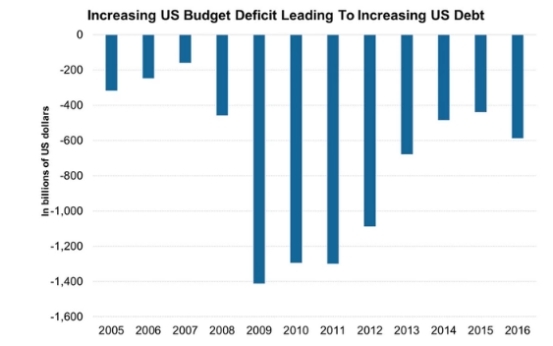

One of the primary concerns for investors is the potential for policy changes under a Democratic administration. A Democratic win could lead to increased spending on social programs, healthcare, and infrastructure, which could boost economic growth in the short term. However, it could also lead to higher taxes on corporations and the wealthy, which could negatively impact profitability and stock prices.

Impact on Key Industries

Several key industries could be significantly affected by a Democratic win. For example:

- Healthcare: Democrats have been pushing for expanded access to healthcare and have vowed to lower prescription drug prices. This could benefit companies that offer affordable healthcare solutions but could also hurt pharmaceutical companies.

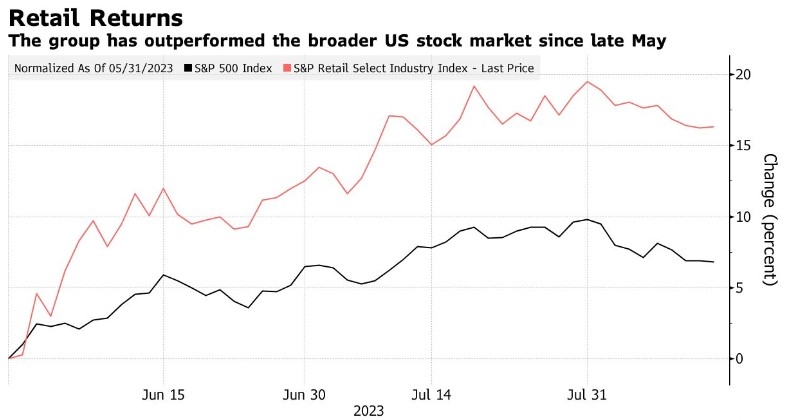

- Tech Industry: The Democratic party has expressed concerns about the power and influence of large tech companies, such as Google, Facebook, and Amazon. This could lead to increased regulation and potentially impact stock prices for these companies.

- Energy: Democrats have been pushing for greater investment in renewable energy and have vowed to phase out fossil fuels. This could benefit renewable energy companies but could also impact the profitability of fossil fuel companies.

Historical Trends

History provides some insight into how political wins have affected the stock market. For example, the 2008 election of Barack Obama, a Democrat, saw the S&P 500 decline by 23% in the months following his victory. However, the market recovered and ended the year with a gain of 26.5%.

In contrast, the 2016 election of Donald Trump, a Republican, saw the S&P 500 rise by 13.4% in the months following his victory. However, the market experienced significant volatility in the weeks leading up to the election, which could be a sign of investor uncertainty.

Case Studies

To further illustrate the potential impact of a Democratic win, let's examine a few case studies:

- Tesla: After the 2008 election, Tesla's stock price fell by approximately 35% in the months following Barack Obama's victory. However, the company's long-term growth prospects remained strong, and the stock eventually recovered.

- Facebook: After the 2016 election, Facebook's stock price fell by approximately 10% in the weeks leading up to the election. However, the stock recovered and ended the year with a gain of 15%.

Conclusion

In conclusion, a Democratic win in the upcoming elections could have a significant impact on U.S. stocks. While the potential for increased spending on social programs and infrastructure could boost economic growth, concerns about higher taxes and increased regulation could negatively impact profitability and stock prices. As with any election, the market's reaction will be influenced by a variety of factors, including investor sentiment and policy announcements. As such, it's important for investors to stay informed and prepared for potential volatility in the weeks and months following the election.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....