Investing in U.S. stocks has become increasingly popular among foreign investors due to the strong market performance and stability of the U.S. economy. However, navigating the American stock market can be challenging, especially for those who are not familiar with the local financial landscape. This guide will provide you with essential information to help you make informed decisions when investing in U.S. stocks.

Understanding the U.S. Stock Market

The U.S. stock market is one of the largest and most liquid in the world, with several major exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. Stocks represent ownership in a company, and when you buy a stock, you are essentially buying a small piece of that company.

Types of Stocks

There are several types of stocks you can invest in, including:

- Common Stocks: These are the most common type of stock, providing you with voting rights and the potential for dividends.

- Preferred Stocks: These stocks typically pay higher dividends than common stocks but do not offer voting rights.

- Blue-Chip Stocks: These are shares of well-established companies with a strong track record and stable earnings.

- Growth Stocks: These stocks are from companies with high growth potential and may not pay dividends.

How to Invest in U.S. Stocks

To invest in U.S. stocks, you will need to open a brokerage account. There are several online brokers available, such as TD Ameritrade, E*TRADE, and Charles Schwab, which offer a range of services and fees.

Once you have an account, you can start buying stocks. You can either place a market order, which executes your trade at the current market price, or a limit order, which allows you to set a specific price at which you want to buy or sell.

Risks and Rewards

Investing in U.S. stocks comes with both risks and rewards. The potential for high returns is significant, but so is the risk of losing your investment. It's important to do your research and understand the risks before investing.

Case Study: Tencent

One example of a successful foreign investment in the U.S. stock market is Tencent Holdings Ltd., a Chinese tech giant. In 2014, Tencent acquired a 33% stake in the popular mobile gaming company Supercell. This investment has since paid off handsomely, with Supercell's games generating billions in revenue.

Key Tips for Foreign Investors

- Understand the U.S. Tax System: As a foreign investor, you may be subject to U.S. taxes on your investment income. It's important to understand the tax implications and consult with a tax professional if necessary.

- Diversify Your Portfolio: Diversifying your investments can help reduce your risk and increase your chances of success.

- Stay Informed: Keep up with the latest news and trends in the U.S. stock market to make informed decisions.

Investing in U.S. stocks can be a lucrative opportunity for foreign investors, but it requires careful planning and research. By understanding the market, choosing the right stocks, and managing your risks, you can increase your chances of success.

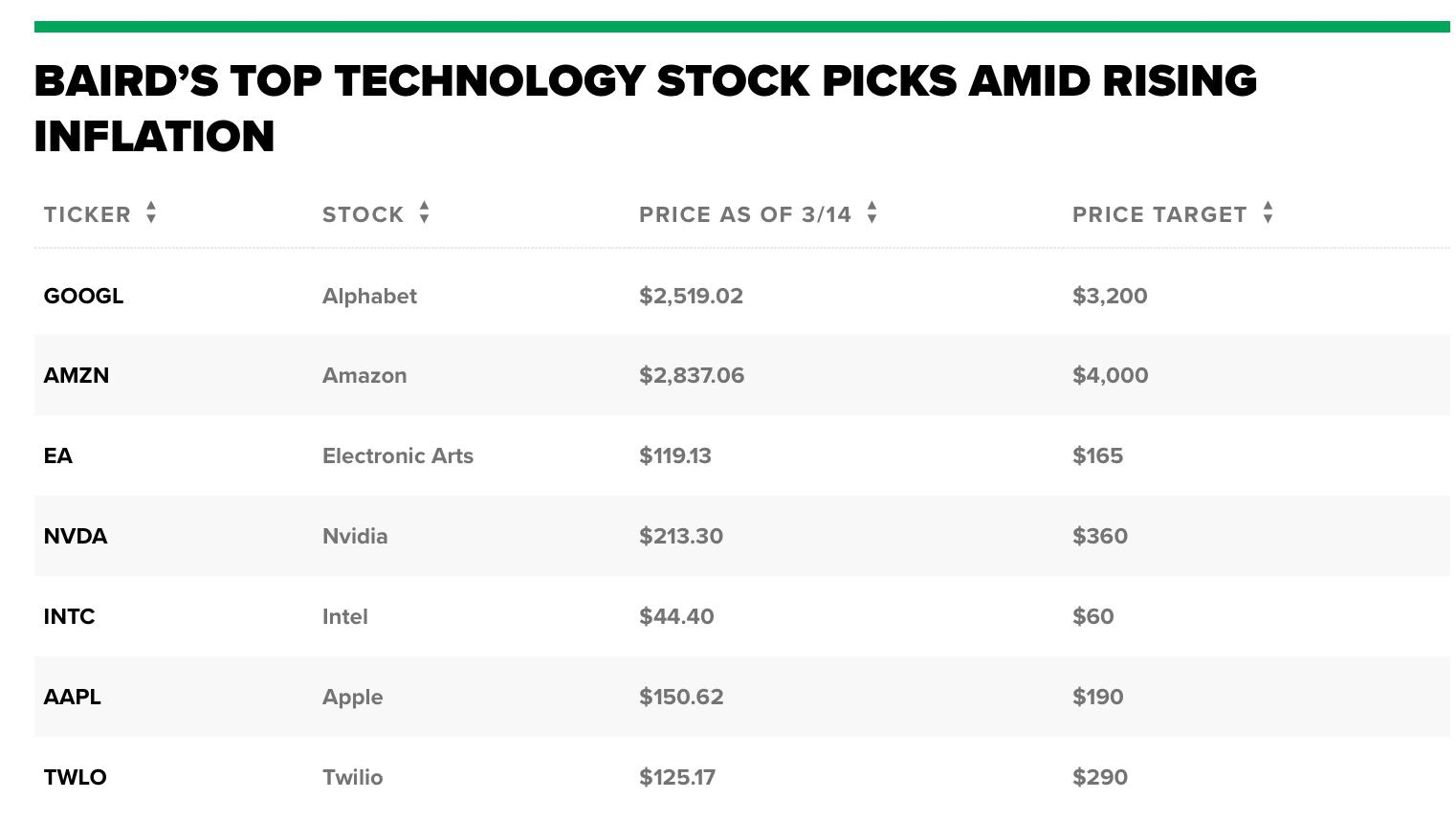

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....