Introduction: In the ever-evolving world of finance, staying informed about stock index prices is crucial for investors and traders alike. The US stock market, being one of the largest and most influential in the world, offers a wealth of opportunities for investment. This article aims to provide a comprehensive understanding of US stock index prices, highlighting key factors that influence them and offering insights into how they can be utilized for investment strategies.

Understanding Stock Indexes: Stock indexes are measures of the overall performance of a group of stocks. They represent a basket of companies across various sectors, providing a snapshot of the market's overall health. The most well-known US stock indexes include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

The S&P 500 is widely regarded as a benchmark for the US stock market. It includes 500 of the largest publicly-traded companies in the United States, covering a wide range of industries. The Dow Jones Industrial Average consists of 30 large, publicly-traded companies and is often seen as a gauge of the broader market's performance. Lastly, the NASDAQ Composite tracks all stocks listed on the NASDAQ stock exchange, making it a representation of technology and growth-oriented companies.

Factors Influencing Stock Index Prices: Several factors can impact the prices of US stock indexes. Understanding these factors can help investors make informed decisions. Some key factors include:

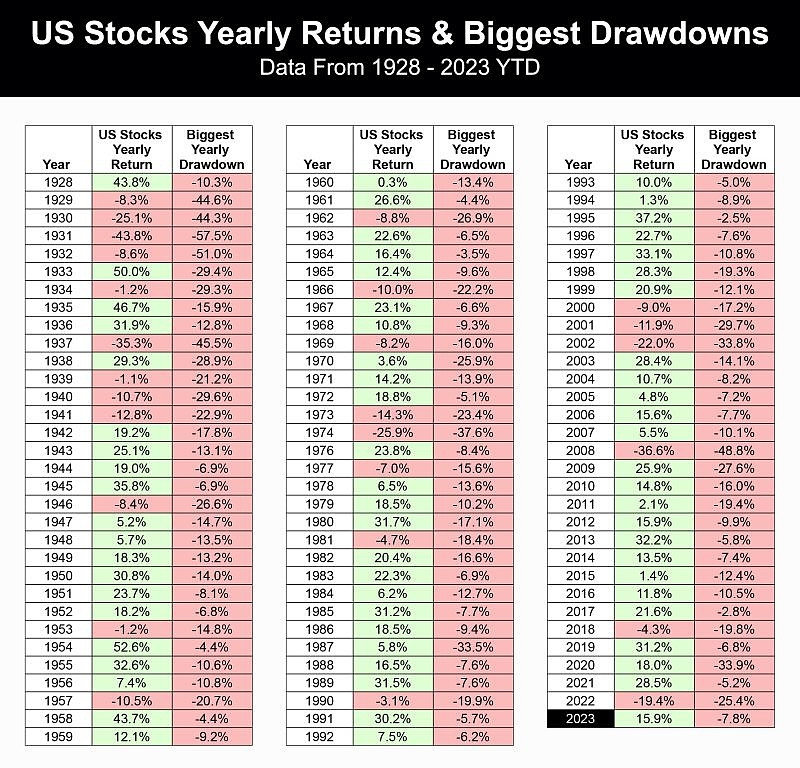

Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly influence stock index prices. Positive economic indicators often lead to higher stock prices, while negative indicators can result in lower prices.

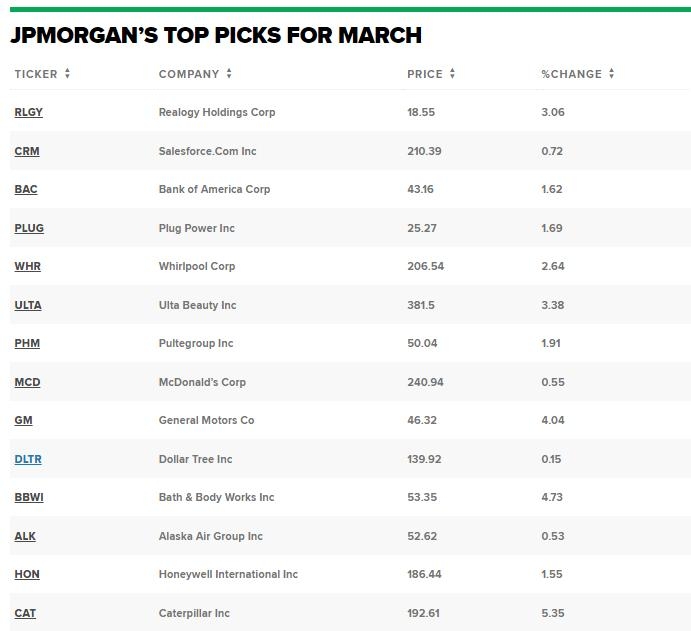

Company Performance: The financial performance of individual companies within the index can impact overall index prices. Strong earnings reports or positive news can drive stock prices higher, while weak performance or negative news can lead to lower prices.

Market Sentiment: Market sentiment refers to the overall outlook and investor psychology within the stock market. When investors are optimistic, stock prices tend to rise, while pessimism can lead to lower prices.

Political and Geopolitical Events: Political events, such as elections or policy changes, and geopolitical tensions can also influence stock index prices. Uncertainty and instability often lead to higher volatility and potential declines in stock prices.

Interest Rates: Changes in interest rates, set by the Federal Reserve, can impact stock index prices. Lower interest rates can stimulate borrowing and spending, potentially boosting stock prices, while higher interest rates can have the opposite effect.

Investment Strategies Using Stock Index Prices: Understanding stock index prices can be beneficial for investors looking to develop effective investment strategies. Here are a few strategies that can be employed:

Index Funds: Index funds are designed to track the performance of a specific stock index, such as the S&P 500. By investing in index funds, investors can gain exposure to a diversified portfolio of stocks without the need for active management.

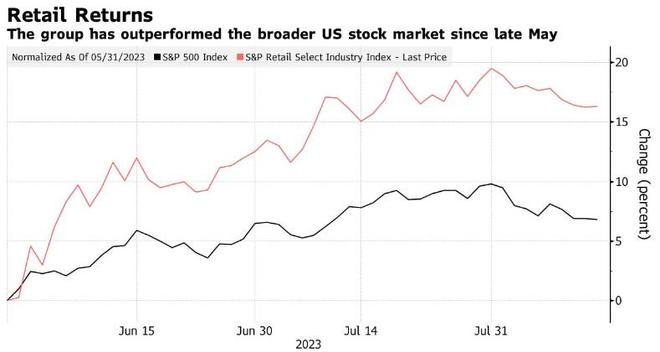

Sector Rotation: Investors can utilize stock index prices to identify sectors that are performing well and adjust their portfolios accordingly. For example, during a technology boom, technology-focused indexes may outperform other sectors.

Market Timing: While market timing is often considered risky, some investors attempt to predict short-term movements in stock indexes to capitalize on potential gains.

Conclusion: Understanding US stock index prices is essential for investors and traders looking to navigate the complex world of the stock market. By considering factors such as economic indicators, company performance, market sentiment, and geopolitical events, investors can make informed decisions and develop effective investment strategies. Whether through index funds, sector rotation, or market timing, staying informed about stock index prices is a key component of successful investing.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....