In recent years, cryptocurrency has emerged as a revolutionary financial asset, captivating the attention of investors worldwide. As the popularity of digital currencies grows, it is natural for many to question its integration into traditional stock markets. This article delves into the current state of cryptocurrency on the US stock market, highlighting its significance and potential impact.

Understanding Cryptocurrency and the Stock Market

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, making it decentralized. On the other hand, the stock market is a platform where shares of publicly traded companies are bought and sold. It provides investors with the opportunity to own a piece of a company, earning dividends and capital gains.

The Growing Presence of Cryptocurrency in the US Stock Market

Several developments have marked the increasing presence of cryptocurrency in the US stock market:

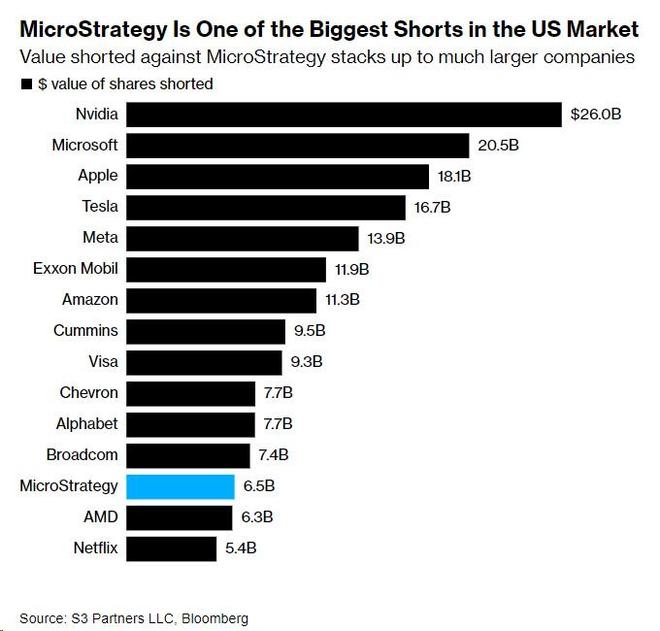

Publicly Traded Cryptocurrency Companies: Some companies have started trading their shares on stock exchanges, with their business models centered around cryptocurrencies. For instance, MicroStrategy (MSTR) has invested heavily in Bitcoin and has been transparent about its crypto investments.

Brokers and Platforms: Many brokerage firms and platforms now offer cryptocurrency trading, allowing investors to buy, sell, and trade digital currencies directly through their accounts. Examples include Coinbase, Gemini, and Robinhood.

ETFs and Trusts: Exchange-Traded Funds (ETFs) and trusts are another way to invest in cryptocurrency through the stock market. These financial instruments track the performance of a specific cryptocurrency or basket of cryptocurrencies, making it easier for investors to gain exposure without owning the actual asset.

Benefits and Risks of Investing in Cryptocurrency through the Stock Market

Investing in cryptocurrency through the stock market offers several benefits, such as:

- Ease of Access: Investors can easily gain exposure to cryptocurrency without the need for specialized knowledge or platforms.

- Diversification: Cryptocurrency can be added to a traditional investment portfolio for diversification purposes, potentially reducing overall risk.

- Liquidity: Many cryptocurrency-related investments are highly liquid, allowing investors to enter and exit positions quickly.

However, there are also risks to consider:

- Volatility: Cryptocurrency is known for its extreme volatility, which can lead to significant gains or losses in a short period.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrency is still evolving, and investors need to stay informed about potential changes that could impact their investments.

- Market Manipulation: Smaller and less established cryptocurrencies may be susceptible to market manipulation, affecting their value.

Case Study: Bitcoin's Impact on the Stock Market

One of the most notable examples of cryptocurrency impacting the stock market is Bitcoin's surge in 2020 and 2021. As Bitcoin gained widespread attention, many tech and financial companies started exploring its potential applications, leading to increased interest in related stocks. This, in turn, fueled a bull run in the stock market, with the S&P 500 reaching record highs.

In conclusion, cryptocurrency's presence in the US stock market is a testament to its growing relevance in the financial world. While there are risks involved, investors should consider adding cryptocurrency to their portfolios as part of a diversified strategy. As the digital currency landscape continues to evolve, it will be crucial for investors to stay informed and adapt to new opportunities and challenges.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....