Are you looking to expand your investment portfolio into the United States but unsure about how to do it from Europe? The idea of buying U.S. stocks from across the Atlantic might seem daunting, but it's actually quite straightforward. In this article, we'll explore the options available to European investors interested in purchasing U.S. stocks.

Understanding U.S. Stocks

What Are U.S. Stocks? U.S. stocks represent ownership in a U.S.-based company. When you buy a stock, you are essentially buying a small piece of that company. U.S. stocks are among the most popular in the world, with a vast array of options available across various sectors and industries.

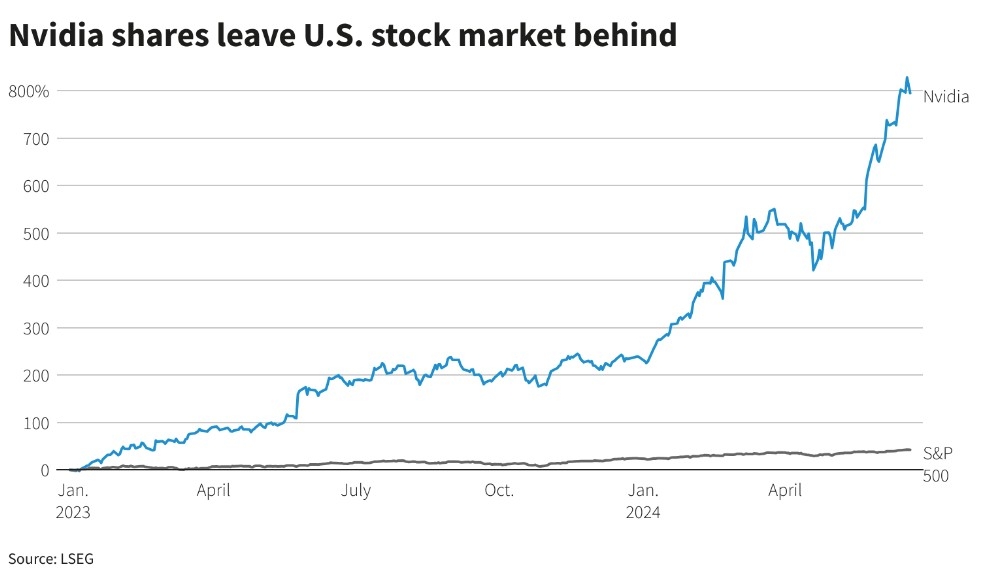

Why Invest in U.S. Stocks? Investing in U.S. stocks can offer several advantages. The U.S. stock market is one of the largest and most liquid in the world, with a wide range of companies across all industries. Additionally, U.S. companies are often seen as stable and profitable, offering investors a chance to diversify their portfolio.

Buying U.S. Stocks from Europe

Online Brokers The most common way to buy U.S. stocks from Europe is through online brokers. These brokers offer platforms that allow you to trade stocks, ETFs, and other securities from around the world. Some popular online brokers for European investors include Interactive Brokers, TD Ameritrade, and E*TRADE.

Account Opening Process To start buying U.S. stocks, you'll need to open an account with an online broker. The process is similar to opening an account with a local broker. You'll need to provide personal and financial information, such as your ID, address, and bank details. Some brokers may require proof of residence or a minimum deposit.

Exchange Rates and Fees

Tax Implications Tax implications are another important factor to consider when investing in U.S. stocks from Europe. Depending on your country of residence, you may be subject to taxes on dividends and capital gains. It's essential to consult with a tax professional to understand the specific tax obligations you'll face.

Case Studies

Investing in Apple from Germany Imagine you are a German investor looking to buy shares of Apple Inc. (AAPL). After opening an account with an online broker, you can easily purchase shares of Apple using the platform. Keep in mind the exchange rate and potential fees, as well as the tax implications.

Investing in Amazon from France Similarly, a French investor interested in investing in Amazon.com Inc. (AMZN) can follow a similar process. By opening an account with a U.S.-based broker, the investor can buy shares of Amazon and benefit from the company's growth potential.

Conclusion

Buying U.S. stocks from Europe is a feasible option for investors looking to diversify their portfolio. With online brokers and the global nature of the stock market, accessing U.S. stocks has never been easier. However, it's essential to consider exchange rates, fees, and tax implications before making your investments.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....