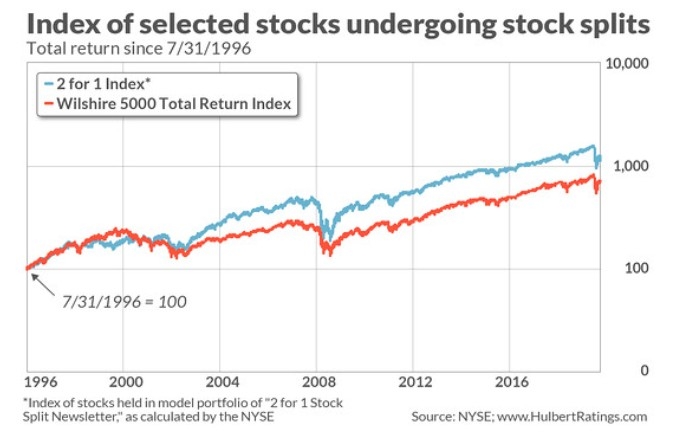

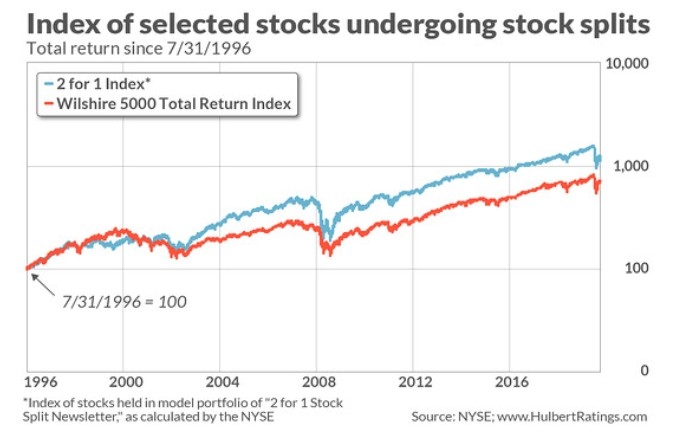

Introduction: The Great Recession, which began in December 2007 and lasted until June 2009, was one of the most severe economic downturns in U.S. history. This article delves into the impact of the Great Recession on the U.S. stock market, analyzing the key factors that led to the market's decline and recovery. By examining the period's volatility and investor sentiment, we can gain valuable insights into the resilience and adaptability of the stock market during times of crisis.

Market Decline:

The U.S. stock market experienced a significant decline during the Great Recession. The Dow Jones Industrial Average (DJIA), a widely followed index, fell from a peak of 14,164.53 on October 9, 2007, to a low of 6,547.05 on March 9, 2009. This represented a loss of approximately 54% in just over a year.

Several factors contributed to the market's decline:

Subprime Mortgage Crisis: The housing market bubble, fueled by loose lending standards and excessive risk-taking by financial institutions, burst in 2007. This led to a wave of mortgage defaults, which in turn caused widespread financial instability.

Credit Crunch: As banks and financial institutions faced liquidity problems, they became reluctant to lend to each other, leading to a credit crunch. This restricted access to credit for businesses and consumers, further exacerbating the economic downturn.

Bank Failures: Many financial institutions, including some of the largest in the country, failed or were bailed out by the government. This eroded investor confidence and contributed to the market's decline.

Global Economic Slowdown: The U.S. recession spread to other countries, leading to a global economic slowdown. This weakened demand for U.S. exports and further damaged the stock market.

Market Recovery:

Despite the initial sharp decline, the U.S. stock market recovered remarkably well from the Great Recession. By the end of 2013, the DJIA had more than doubled from its March 2009 low.

Several factors contributed to the market's recovery:

Government Intervention: The U.S. government implemented various measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the Federal Reserve's quantitative easing (QE) programs. These measures helped restore confidence in the market.

Improving Economic Conditions: As the housing market stabilized and credit conditions improved, the U.S. economy began to recover. This led to increased corporate earnings and, consequently, higher stock prices.

Low Interest Rates: The Federal Reserve kept interest rates near zero for an extended period, making it cheaper for businesses and consumers to borrow and invest. This encouraged stock market participation and contributed to the market's recovery.

Technological Advancements: The growth of technology companies, such as Apple, Google, and Facebook, played a significant role in the market's recovery. These companies generated substantial revenue and profits, attracting investors to the stock market.

Case Study: Bank of America

One notable example of a company affected by the Great Recession is Bank of America. Before the crisis, Bank of America was one of the largest financial institutions in the country. However, it faced significant challenges during the downturn:

Subprime Mortgage Exposure: Bank of America had a substantial exposure to subprime mortgages, which led to massive losses when the housing market collapsed.

Merger with Merrill Lynch: In 2008, Bank of America acquired Merrill Lynch, a move that further exacerbated its financial problems. The acquisition was initially seen as a way to strengthen the company, but it ended up adding to its debt load.

Despite these challenges, Bank of America managed to recover and emerged as a stronger institution. The company implemented several strategies, including cost-cutting measures and divesting non-core assets, to improve its financial health.

Conclusion:

The Great Recession had a profound impact on the U.S. stock market, leading to a significant decline in stock prices. However, the market's resilience and adaptability allowed it to recover quickly. By understanding the factors that contributed to the market's decline and recovery, investors can better navigate future market downturns and capitalize on opportunities.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....