The US stock market has been a beacon of economic vitality, attracting investors from all corners of the globe. But how is the US stock market doing right now? In this article, we delve into the current state of the US stock market, exploring key trends and insights that could impact your investment decisions.

Market Performance Overview

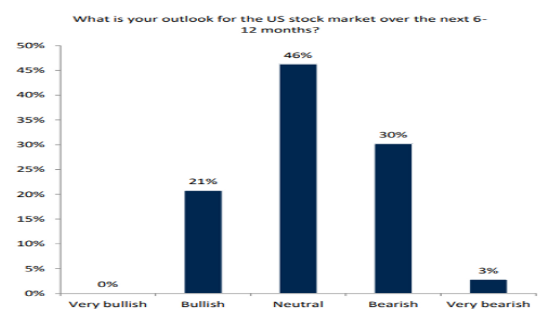

As of the latest data, the US stock market has been experiencing a period of volatility. This volatility can be attributed to several factors, including geopolitical tensions, inflation concerns, and corporate earnings reports.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA) has been fluctuating significantly. The index, which includes 30 large companies, has seen its ups and downs over the past few months. While the index has experienced some setbacks, it has also recovered from previous lows, reflecting the resilience of the US stock market.

S&P 500

The Standard & Poor's 500 (S&P 500) index, which tracks the performance of 500 large companies, has been another key indicator of the US stock market's health. The S&P 500 has experienced similar fluctuations to the DJIA, with periods of both growth and decline.

NASDAQ Composite

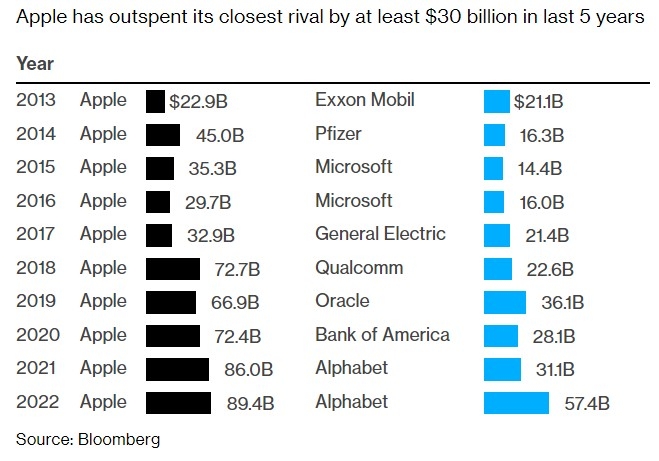

The NASDAQ Composite index, which includes technology companies, has been a standout performer in recent months. The index has seen significant growth, driven by strong performance from major tech companies such as Apple, Microsoft, and Amazon.

Key Trends

Several key trends are shaping the current state of the US stock market:

1. Geopolitical Tensions: Geopolitical tensions, particularly around global trade and the US-China relationship, have been a significant factor impacting the stock market. These tensions have led to uncertainty and volatility in the market.

2. Inflation Concerns: Rising inflation has raised concerns among investors, as it could lead to higher interest rates and increased costs for businesses. This has resulted in some market pullbacks.

3. Corporate Earnings: The release of corporate earnings reports has been a key driver of market movements. Strong earnings reports can boost investor confidence, while weaker reports can lead to sell-offs.

Case Studies

To illustrate these trends, let's look at a few case studies:

1. Apple Inc.: Apple has been a standout performer in the technology sector, with its stock price reaching new highs. This has been driven by strong demand for its products and robust earnings reports.

2. Tesla Inc.: Tesla has seen significant volatility in its stock price, reflecting investor sentiment and market trends. While the company has seen strong growth, it has also faced challenges, such as supply chain issues and regulatory scrutiny.

3. Microsoft Corporation: Microsoft has been a steady performer in the tech sector, with its stock price experiencing modest growth. The company's focus on cloud computing and other technology services has helped drive its success.

Conclusion

The US stock market is currently experiencing a period of volatility, driven by various factors. However, despite the challenges, the market remains resilient and has shown potential for growth. As an investor, it's crucial to stay informed about these trends and consider them when making investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....