In today's rapidly changing financial landscape, the U.S. stock market is often marked by high volatility. This article aims to explore the reasons behind this phenomenon and how investors can navigate through it effectively. From the rise of digital platforms to geopolitical events, there are several factors that contribute to the increased volatility in the U.S. stock market.

Understanding High Volatility

High volatility in the stock market refers to rapid and substantial price movements, either up or down. It can occur for a variety of reasons, such as economic news, company earnings reports, geopolitical events, and even investor sentiment.

Factors Contributing to High Volatility in the US Stock Market

Technological Advancements: The rise of digital platforms has made it easier for investors to buy and sell stocks, leading to increased liquidity and higher trading volumes. This has, in turn, led to higher volatility.

Global Economic Events: The U.S. stock market is intricately linked with the global economy. Economic developments in other countries can have a significant impact on U.S. stocks, leading to higher volatility.

Geopolitical Events: Political events, such as elections or international tensions, can create uncertainty in the market, causing prices to fluctuate wildly.

Company Earnings Reports: When companies release their earnings reports, it can lead to significant movements in their stock prices, which can, in turn, impact the broader market.

Investor Sentiment: The mood of investors can also drive volatility. When investors are optimistic, stock prices can soar. Conversely, when they are pessimistic, prices can plummet.

Navigating High Volatility

Navigating through high volatility requires a well-thought-out strategy. Here are some tips for investors:

Diversification: Diversifying your portfolio can help reduce the impact of high volatility. By investing in a variety of asset classes, you can minimize the risk of a significant loss in any one stock.

Risk Management: Understanding and managing your risk tolerance is crucial. This involves setting stop-loss orders and only investing money you can afford to lose.

Stay Informed: Keep up with the latest news and developments that can impact the market. This will help you make more informed decisions.

Avoid Emotional Investing: Emotional decisions often lead to poor outcomes. Instead, focus on long-term investment strategies.

Use Professional Advice: Consider consulting with a financial advisor to help you navigate through volatile markets.

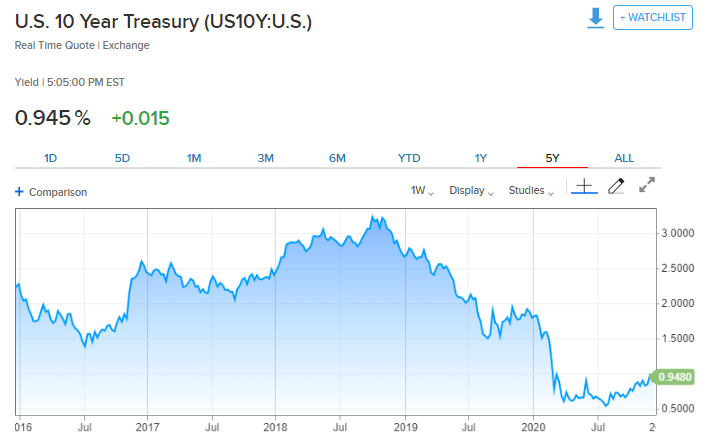

Case Study: The 2020 Stock Market Crash

One of the most significant examples of high volatility in the U.S. stock market was the 2020 stock market crash, caused by the COVID-19 pandemic. The S&P 500 index dropped by over 30% in a matter of weeks. However, it also rebounded strongly, recovering much of its losses in the subsequent months.

This case study illustrates how even in the face of a significant crisis, the market can quickly recover. It also underscores the importance of maintaining a diversified portfolio and staying informed during volatile periods.

In conclusion, high volatility is a reality of the U.S. stock market. However, by understanding the factors contributing to this volatility and implementing effective strategies, investors can navigate through these turbulent times. Remember to diversify your portfolio, manage your risk, and stay informed to protect your investments.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....