In the ever-evolving world of cryptocurrencies, Cronos (CRO) has emerged as a significant player. As the native cryptocurrency of the Cronos Chain, Cronos is designed to offer a seamless, scalable, and secure platform for decentralized applications and digital assets. This article delves into the details of Cronos stock in the US, exploring its market performance, potential, and future prospects.

Introduction to Cronos

Cronos is a blockchain platform that aims to provide a user-friendly and efficient infrastructure for decentralized applications and digital assets. Launched in 2016, Cronos was developed by the Kava Labs, a team of blockchain experts with a strong background in finance and technology. The platform operates on the Ethereum network and is compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port their Ethereum-based applications to Cronos.

Market Performance of Cronos Stock

The performance of Cronos stock in the US has been quite impressive. Since its inception, Cronos has seen significant growth in its market capitalization. As of the time of writing, Cronos is ranked as one of the top cryptocurrencies by market capitalization, with a strong presence in the US market.

Historical Performance

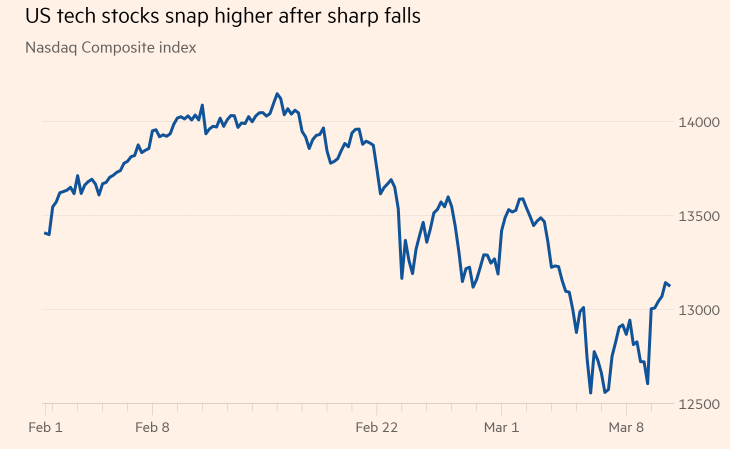

In the past few years, Cronos has experienced a rollercoaster ride in terms of market performance. In 2021, the cryptocurrency saw a surge in its value, reaching an all-time high of over $100. However, the market faced a significant correction in 2022, and Cronos, like many other cryptocurrencies, saw its value plummet.

Current Market Trends

Despite the recent volatility, Cronos has managed to maintain a strong position in the market. The cryptocurrency is currently trading at around $15, which is a significant recovery from its 2022 lows. This resilience can be attributed to several factors, including the growing adoption of Cronos in the US and its increasing utility as a platform for decentralized applications.

Potential of Cronos Stock

The potential of Cronos stock in the US is immense. The platform's focus on scalability, security, and compatibility with Ethereum has made it a preferred choice for developers and investors alike.

Scalability

One of the major advantages of Cronos is its scalability. The platform uses a unique proof-of-stake consensus mechanism that allows it to process transactions at a much higher rate than Ethereum. This makes Cronos an ideal platform for decentralized applications that require high transaction throughput.

Security

Cronos also boasts robust security features, making it a reliable platform for storing and transferring digital assets. The platform uses advanced cryptographic techniques and smart contracts to ensure the security of transactions and assets.

Compatibility with Ethereum

Cronos' compatibility with Ethereum is another significant advantage. This allows developers to easily port their Ethereum-based applications to Cronos, thereby increasing the platform's utility and adoption.

Case Studies

Several case studies have highlighted the potential of Cronos in the US market. For instance, Chainlink, a decentralized oracle network, has integrated Cronos as one of its supported blockchains. This integration has not only increased the utility of Cronos but has also attracted more developers to the platform.

Another notable case is the Cronos-based decentralized finance (DeFi) platform, which has seen a surge in popularity among US investors. The platform offers a variety of DeFi services, including lending, borrowing, and trading, all powered by Cronos.

Conclusion

In conclusion, Cronos stock in the US has shown promising potential. With its focus on scalability, security, and compatibility with Ethereum, Cronos is well-positioned to become a leading cryptocurrency platform in the US market. As the adoption of decentralized applications and digital assets continues to grow, Cronos is likely to see further growth in its market capitalization and trading volume.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....