In the vast landscape of the United States stock market, middle market stocks have emerged as a strategic investment opportunity for both seasoned investors and newcomers alike. These stocks represent a unique segment of the market, offering a balance between the stability of large-cap companies and the growth potential of small-caps. In this article, we delve into the characteristics, benefits, and strategies for investing in US middle market stocks.

Understanding Middle Market Stocks

Middle market stocks are typically found between small-cap and large-cap companies in terms of market capitalization. Generally, these companies have a market cap ranging from

Characteristics of Middle Market Stocks

- Stability: Middle market stocks tend to offer more stability than small-caps due to their larger size and more diversified business models.

- Growth Potential: Despite their size, these companies still have significant growth potential, often expanding into new markets or acquiring smaller competitors.

- Dividends: Many middle market stocks pay dividends, providing investors with a steady income stream.

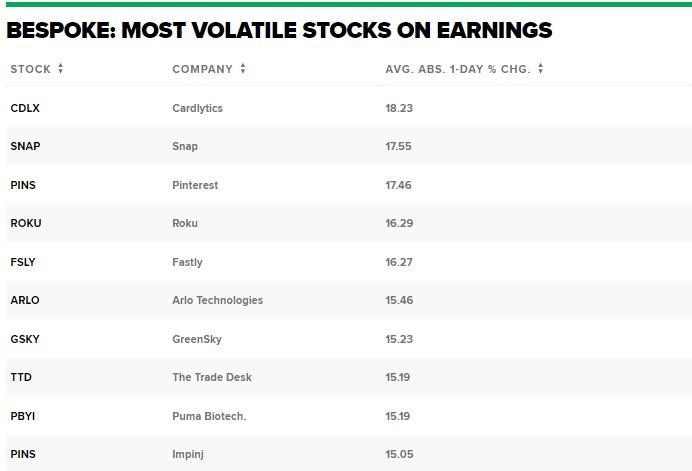

- Less Volatility: Middle market stocks are typically less volatile than small-caps, making them a good option for risk-averse investors.

Benefits of Investing in Middle Market Stocks

- Risk-Reward Balance: Middle market stocks offer a balanced risk-reward profile, making them suitable for a wide range of investors.

- Diversification: Investing in middle market stocks can help diversify your portfolio, reducing the risk of market fluctuations.

- Access to Growth: These companies often have the resources and expertise to grow their businesses and generate significant returns for investors.

- Economic Resilience: Middle market stocks tend to be more resilient during economic downturns, as they have a more stable business model compared to small-caps.

Strategies for Investing in Middle Market Stocks

- Research and Analysis: Conduct thorough research on potential investments, including analyzing financial statements, understanding the company's business model, and assessing its competitive position in the market.

- Diversification: Diversify your portfolio by investing in a variety of middle market stocks across different industries and sectors.

- Long-Term Perspective: Consider a long-term investment horizon, as middle market stocks may take time to realize their full potential.

- Stay Informed: Keep up-to-date with market trends, economic indicators, and company news to make informed investment decisions.

Case Studies

To illustrate the potential of middle market stocks, let's consider a few case studies:

- Darden Restaurants: This company, which owns brands like Olive Garden and Red Lobster, has a market cap of around $7 billion. Over the past five years, the stock has delivered a return of over 50%, showcasing the growth potential of middle market stocks.

- NVIDIA: Although not a middle market stock in terms of market cap, NVIDIA has demonstrated the potential of investing in companies with strong growth prospects. With a market cap of over $500 billion, NVIDIA has seen its stock price soar over the past decade, making it a prime example of a company with significant growth potential.

In conclusion, US middle market stocks offer a compelling investment opportunity for those seeking a balance between stability and growth. By conducting thorough research, diversifying your portfolio, and maintaining a long-term perspective, you can potentially benefit from the strong performance of these companies.

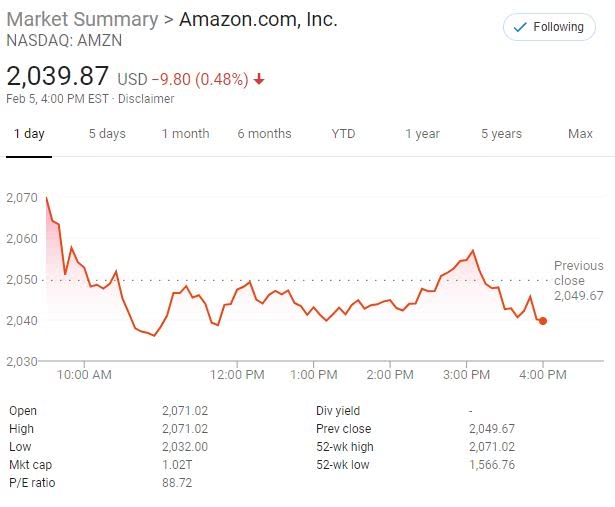

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....