Are you considering investing in US stocks but unsure if it's the right move for you? Investing in the stock market can be a great way to grow your wealth, but it's important to make informed decisions. In this article, we'll explore the benefits and risks of buying US stocks, and help you decide whether it's a suitable investment for your financial goals.

Understanding the US Stock Market

The US stock market is one of the largest and most diversified in the world. It's home to some of the biggest and most successful companies, such as Apple, Microsoft, and Amazon. Investing in US stocks can offer several advantages:

- Potential for High Returns: Historically, the US stock market has provided higher returns than other investment options, such as bonds or savings accounts.

- Diversification: Investing in a mix of US stocks can help reduce your risk, as different companies and sectors may perform differently over time.

- Access to Global Markets: By investing in US stocks, you can gain exposure to companies that operate globally, allowing you to benefit from the growth of emerging markets.

Benefits of Investing in US Stocks

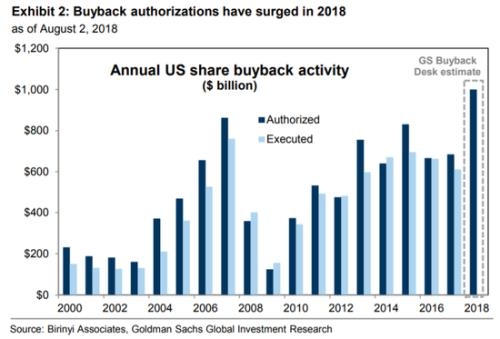

1. Strong Economic Growth

The US economy has been growing consistently over the past few years, which has positively impacted the stock market. As the economy grows, companies tend to generate higher profits, leading to increased stock prices.

2. Innovation and Technology

The US is known for its technological advancements, and many of the world's leading tech companies are based here. Investing in US tech stocks can provide access to innovative products and services that are shaping the future.

3. Dividend Yields

Many US companies offer dividends, which can provide a regular income stream. Dividends are paid out of a company's profits and can be a good source of passive income for investors.

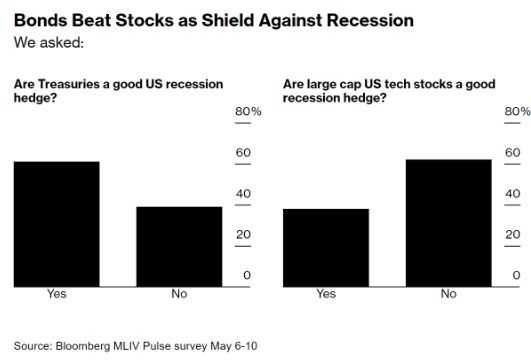

Risks of Investing in US Stocks

While investing in US stocks can be beneficial, it's important to be aware of the risks involved:

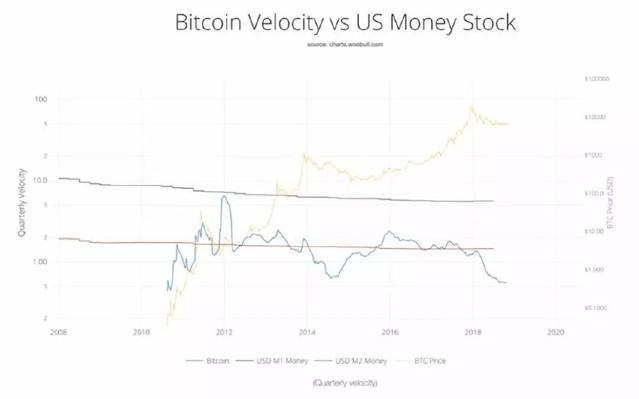

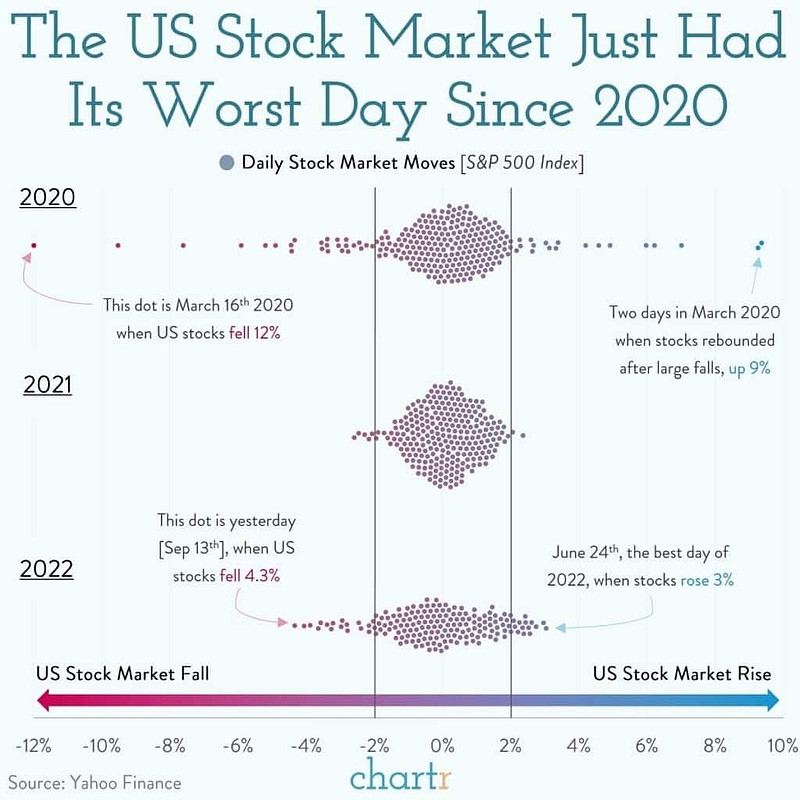

- Market Volatility: The stock market can be unpredictable, and prices can fluctuate significantly over short periods of time.

- Political and Economic Risks: Changes in government policies, economic conditions, and global events can impact the stock market.

- Company-Specific Risks: Individual companies may face challenges such as poor management, competition, or regulatory issues, which can affect their stock prices.

When to Buy US Stocks

Before deciding to buy US stocks, consider the following factors:

- Financial Goals: Ensure that investing in US stocks aligns with your long-term financial goals.

- Risk Tolerance: Assess your risk tolerance to determine how much risk you're willing to take on.

- Investment Strategy: Develop a well-defined investment strategy that includes diversification and regular monitoring.

Case Study: Apple Inc.

Apple Inc. is a prime example of a successful US stock investment. Since its initial public offering (IPO) in 1980, Apple's stock price has soared, providing investors with substantial returns. However, it's important to note that investing in Apple involved risks, such as market volatility and competition from other tech companies.

Conclusion

Buying US stocks can be a great way to grow your wealth, but it's crucial to conduct thorough research and consider your financial goals and risk tolerance. By understanding the benefits and risks, you can make an informed decision on whether investing in US stocks is the right move for you.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....