Introduction

The United Kingdom's decision to leave the European Union, commonly known as Brexit, has sparked a wave of uncertainty across global markets. As investors, it's crucial to understand how this political event could impact U.S. stocks. This article delves into the potential effects of Brexit on the U.S. stock market, providing insights into various sectors and investment strategies.

Brexit's Impact on U.S. Stocks

Dollar Strength: The value of the British pound has plummeted since the Brexit vote, leading to a stronger U.S. dollar. This can have a mixed impact on U.S. stocks. While it benefits companies with significant international operations, it can negatively affect companies with a high exposure to Europe, particularly in the technology and consumer goods sectors.

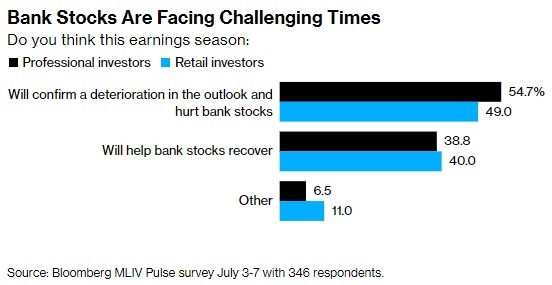

Financial Sector: The financial sector is likely to be one of the most affected by Brexit. As the UK's financial industry is a major global hub, any disruption in its operations could have a ripple effect on U.S. financial stocks. However, companies like JPMorgan Chase and Goldman Sachs have diversified their operations globally, mitigating potential risks.

Technology Sector: U.S. technology companies, such as Apple and Microsoft, have significant operations in the UK. A weaker pound could make their products more expensive in the UK market, potentially affecting their sales. However, these companies have a strong presence in other regions, making them less vulnerable to Brexit's impact.

Consumer Goods Sector: Companies like Procter & Gamble and Coca-Cola have a significant presence in the UK. A weaker pound could make their products more expensive for British consumers, potentially affecting their sales. However, these companies have a diverse portfolio of products and markets, making them somewhat resilient to Brexit's impact.

Energy Sector: The energy sector could benefit from Brexit. As the UK reduces its reliance on European energy imports, it may increase its imports from the U.S. This could benefit U.S. energy companies like ExxonMobil and Chevron.

Automotive Sector: The automotive industry is heavily dependent on trade between the UK and the EU. A no-deal Brexit could lead to increased tariffs and trade barriers, affecting companies like Ford and General Motors.

Investment Strategies

Diversification: Diversifying your portfolio across various sectors and regions can help mitigate the impact of Brexit on your investments.

Focus on Companies with Diversified Operations: Investing in companies with a strong global presence can help protect your portfolio from the potential negative effects of Brexit.

Monitor Currency Fluctuations: Keep an eye on the exchange rate between the pound and the dollar, as it can impact the performance of companies with significant operations in the UK.

Stay Informed: Stay updated with the latest news and developments related to Brexit, as it can significantly impact the U.S. stock market.

Conclusion

Brexit's impact on the U.S. stock market is complex and multifaceted. While it presents certain risks, it also offers opportunities. By understanding the potential effects of Brexit on various sectors and adopting a diversified investment strategy, investors can navigate this uncertain landscape and potentially benefit from the long-term growth of the U.S. stock market.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....