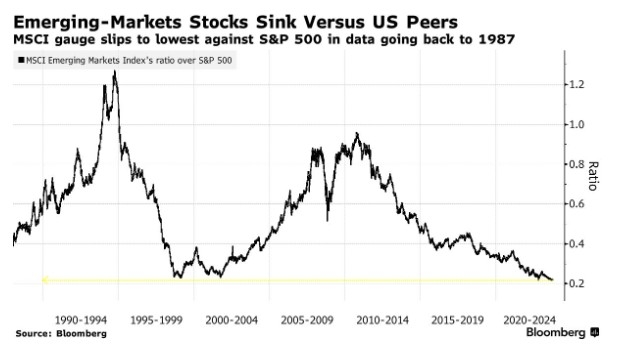

In the annals of financial history, the 1987 US stock market crash stands out as one of the most significant and unexpected events. This article delves into the causes, effects, and lessons learned from this pivotal moment, offering a comprehensive analysis of the 1987 stock market crash.

Causes of the 1987 Stock Market Crash

The 1987 stock market crash, often referred to as "Black Monday," was triggered by a combination of factors. Economic factors such as high interest rates, inflation, and the Federal Reserve's tight monetary policy played a significant role. Additionally, market speculation and program trading exacerbated the situation.

Market Speculation

One of the key reasons behind the crash was the excessive speculation in the stock market. Investors, driven by greed and the allure of high returns, bought stocks without a solid fundamental basis. This speculative bubble eventually burst, leading to a sharp decline in stock prices.

Program Trading

Program trading, or algorithmic trading, also contributed to the crash. These automated trading systems executed trades based on mathematical models, leading to rapid and often erratic movements in the market. When these systems sold off stocks, it triggered a domino effect, causing panic selling and further plummeting stock prices.

Effects of the 1987 Stock Market Crash

The crash had profound effects on the global economy. The Dow Jones Industrial Average (DJIA) plummeted by 22.6% on October 19, 1987, the largest one-day percentage decline in its history. This was followed by a further decline of 10.3% in the following week.

The crash also led to a loss of confidence in the financial markets. Investors, businesses, and policymakers were left reeling from the unexpected and severe downturn. However, the crash also highlighted the resilience of the US economy and its ability to recover from such a shock.

Lessons Learned from the 1987 Stock Market Crash

The 1987 stock market crash taught several valuable lessons. Firstly, it emphasized the importance of regulation in the financial markets. The crash prompted the Securities and Exchange Commission (SEC) to review and strengthen its regulations to prevent such a disaster from occurring again.

Secondly, it highlighted the risks associated with speculation and program trading. The crash prompted a renewed focus on the need for transparency and accountability in the financial markets.

Case Study: The 1987 Stock Market Crash

One of the most notable examples of the 1987 stock market crash was the collapse of the stock of the investment bank Drexel Burnham Lambert. The firm, led by Michael Milken, was at the center of the junk bond boom, which was a significant contributor to the speculative bubble. The crash led to the collapse of Drexel Burnham Lambert, marking the end of the junk bond era.

Conclusion

The 1987 US stock market crash remains a pivotal event in financial history. It serves as a stark reminder of the risks associated with excessive speculation and the importance of regulation in the financial markets. By understanding the causes and effects of the crash, investors and policymakers can better prepare for future market disruptions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....