In the dynamic world of finance, US insurance stocks have emerged as a crucial segment for investors seeking stable and long-term growth. This article delves into the key aspects of US insurance stocks, providing insights into their performance, investment potential, and factors that influence their market value.

Understanding US Insurance Stocks

US insurance stocks refer to the shares of publicly-traded insurance companies based in the United States. These companies offer various types of insurance, including life, property, and casualty insurance. Some of the leading players in this sector include MetLife, Prudential Financial, and Allstate.

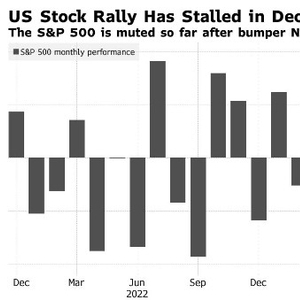

Performance of US Insurance Stocks

Over the past few years, US insurance stocks have displayed robust performance, driven by factors such as economic growth, low interest rates, and favorable regulatory environment. According to data from the S&P 500, the insurance sector has outperformed the overall market in several instances.

Investment Potential of US Insurance Stocks

Investing in US insurance stocks can offer several benefits:

- Stable Dividends: Many insurance companies have a long history of paying dividends to their shareholders, making them an attractive option for income-seeking investors.

- Long-Term Growth: The insurance industry is resilient to economic cycles, making US insurance stocks a good bet for long-term growth.

- Diversification: Insurance stocks can be a valuable addition to a diversified investment portfolio, as they often exhibit low correlation with other asset classes.

Factors Influencing US Insurance Stocks

Several factors can influence the performance of US insurance stocks:

- Interest Rates: Interest rates play a crucial role in the insurance industry, as they affect the cost of capital and the yield on investments. A rise in interest rates can boost the profitability of insurance companies.

- Regulatory Changes: Changes in regulations can have a significant impact on the insurance industry. For example, the introduction of the Affordable Care Act (ACA) in 2010 had a substantial impact on the health insurance sector.

- Economic Conditions: Economic growth and stability are crucial for the insurance industry, as they determine the demand for insurance products.

Case Studies

To illustrate the potential of US insurance stocks, let's consider two case studies:

- MetLife: MetLife is one of the largest life insurance companies in the United States. Over the past five years, the company has seen a steady increase in its share price, driven by strong earnings growth and dividend increases.

- Allstate: Allstate is a leading property and casualty insurance company. The company has been able to maintain its profitability even during economic downturns, making it a reliable investment option.

Conclusion

In conclusion, US insurance stocks offer a promising investment opportunity for investors seeking stability, dividends, and long-term growth. By understanding the key factors that influence their performance and analyzing leading companies in the sector, investors can make informed decisions and achieve their financial goals.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....