The stock market is a dynamic entity, and its early morning activity, often referred to as the premarket, can provide crucial insights into the day's trading trends. Among these early market activities, the US Stock Future Premarket stands out as a pivotal time for investors and traders. This article delves into the significance of the US Stock Future Premarket, explaining what it is, why it matters, and how to navigate this crucial phase.

What is the US Stock Future Premarket?

The US Stock Future Premarket is a period before the official opening of the stock exchanges, where traders and investors can speculate on the future price movements of various stocks and indices. This premarket session typically begins a few hours before the regular trading hours and ends right before the market opens.

Why Does the US Stock Future Premarket Matter?

Insights into Market Sentiment: The US Stock Future Premarket gives investors a glimpse into the market sentiment. By observing the movement of stock futures, traders can gauge how the market might perform throughout the day.

Opportunities for Early Entry: For active traders, the premarket session offers an opportunity to enter or exit positions before the market officially opens. This can be advantageous for those who want to capitalize on early market movements.

Impact on Regular Trading Hours: The movements in the US Stock Future Premarket can significantly influence the regular trading hours. Large movements during this session can lead to volatility and potentially impact the market's overall direction.

Navigating the US Stock Future Premarket

To successfully navigate the US Stock Future Premarket, it is essential to understand a few key concepts:

Understanding Stock Futures: Stock futures are contracts that allow investors to speculate on the future price of a stock. Familiarize yourself with how stock futures work and how they differ from actual stocks.

Monitoring Market Indicators: Keep an eye on market indicators such as the S&P 500, Dow Jones, and NASDAQ futures. These indices can provide a general sense of where the market might be heading.

Setting Realistic Goals: Like any trading activity, the US Stock Future Premarket requires discipline and a clear strategy. Set realistic goals and stick to them.

Case Studies

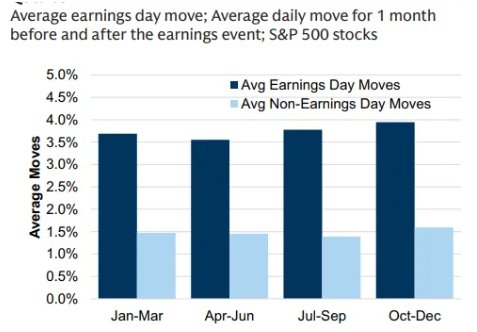

Consider a scenario where the S&P 500 futures open higher than their previous close. This might indicate a positive sentiment in the market, prompting traders to buy stocks ahead of the market opening. Conversely, if the futures open significantly lower, it could signal a negative market sentiment, leading traders to sell off their positions.

Conclusion

The US Stock Future Premarket is a crucial period that can provide valuable insights into the market's direction. By understanding the basics and developing a solid strategy, investors and traders can make informed decisions and potentially capitalize on early market movements. Keep in mind that the stock market is unpredictable, and it's essential to stay informed and adapt to changing conditions.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....