In recent years, the possibility of a U.S. default has become a hot topic in financial markets. The mere mention of such an event sends shockwaves through the stock market, raising concerns about the future of investments. This article delves into the potential effects of a U.S. default on stocks, providing investors with valuable insights to navigate through uncertain times.

The Basics of a U.S. Default

A U.S. default occurs when the federal government is unable to meet its financial obligations, typically due to a failure to raise sufficient revenue or make necessary cuts to spending. This can happen if the government runs out of money to pay its bills, including interest on the national debt.

Impact on Stock Market

The stock market is highly sensitive to economic and political events, and a U.S. default is no exception. Here's how it could potentially impact stocks:

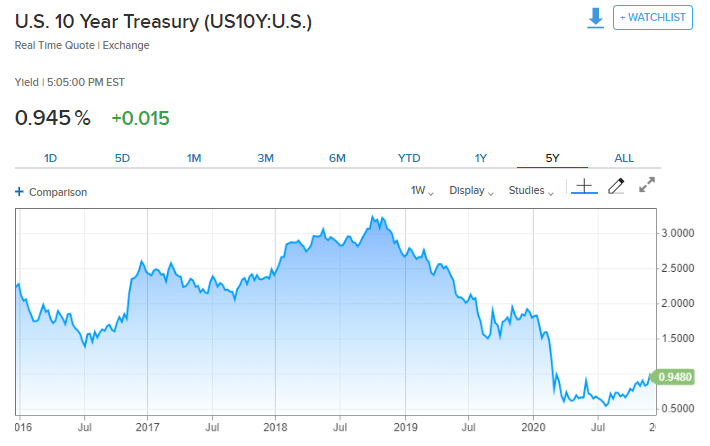

- Rising Interest Rates: A default could lead to a loss of confidence in the U.S. government's ability to manage its finances, causing investors to demand higher returns on their investments. This would likely result in rising interest rates, which can negatively impact stocks, particularly those in sectors sensitive to borrowing costs, such as real estate and utilities.

- Currency Devaluation: A default could weaken the U.S. dollar, making imports more expensive and potentially leading to inflation. This could hurt companies with significant international exposure, as their profits would be eroded by the stronger foreign currencies.

- Market Volatility: The uncertainty surrounding a default could lead to increased market volatility, with investors selling off stocks in a bid to protect their portfolios. This could result in sharp declines in stock prices, making it challenging for investors to time their exits.

- Sector-Specific Impacts: Certain sectors may be more vulnerable to a default than others. For example, financial stocks could be hit hard due to the potential for increased credit risk, while consumer discretionary stocks may suffer as consumers cut back on spending in response to higher interest rates and inflation.

Case Studies

To illustrate the potential impact of a U.S. default on stocks, let's consider a few historical examples:

- 2011 Debt Ceiling Crisis: In 2011, the U.S. government faced a potential default due to a deadlock over the debt ceiling. This led to a downgrade of the U.S. credit rating by Standard & Poor's, causing significant volatility in the stock market. The S&P 500 index fell by nearly 20% over the following six months.

- 2013 Government Shutdown: In 2013, the U.S. government shut down for 16 days due to a budget impasse. While this did not lead to a default, it caused the S&P 500 index to fall by nearly 5% during the shutdown period.

Conclusion

A U.S. default could have far-reaching implications for the stock market, leading to rising interest rates, currency devaluation, market volatility, and sector-specific impacts. Investors should stay informed and be prepared to adjust their portfolios accordingly in the event of a default. By understanding the potential risks and taking proactive measures, investors can better navigate through uncertain times and protect their investments.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....