In the ever-evolving world of finance, understanding the correlation between stocks and the US dollar is crucial for investors looking to make informed decisions. The US dollar, often referred to as the world's reserve currency, plays a pivotal role in global financial markets. This article delves into the stocks that are most closely associated with the US dollar, providing insights into how these investments can impact your portfolio.

Understanding the US Dollar's Influence

The US dollar's status as the world's reserve currency means that it is widely used in international trade and finance. This global demand for the US dollar makes it a major driver of financial markets, including stocks. When the US dollar strengthens, it can positively or negatively impact stocks, depending on various factors.

Stocks to Watch When the US Dollar Strengthens

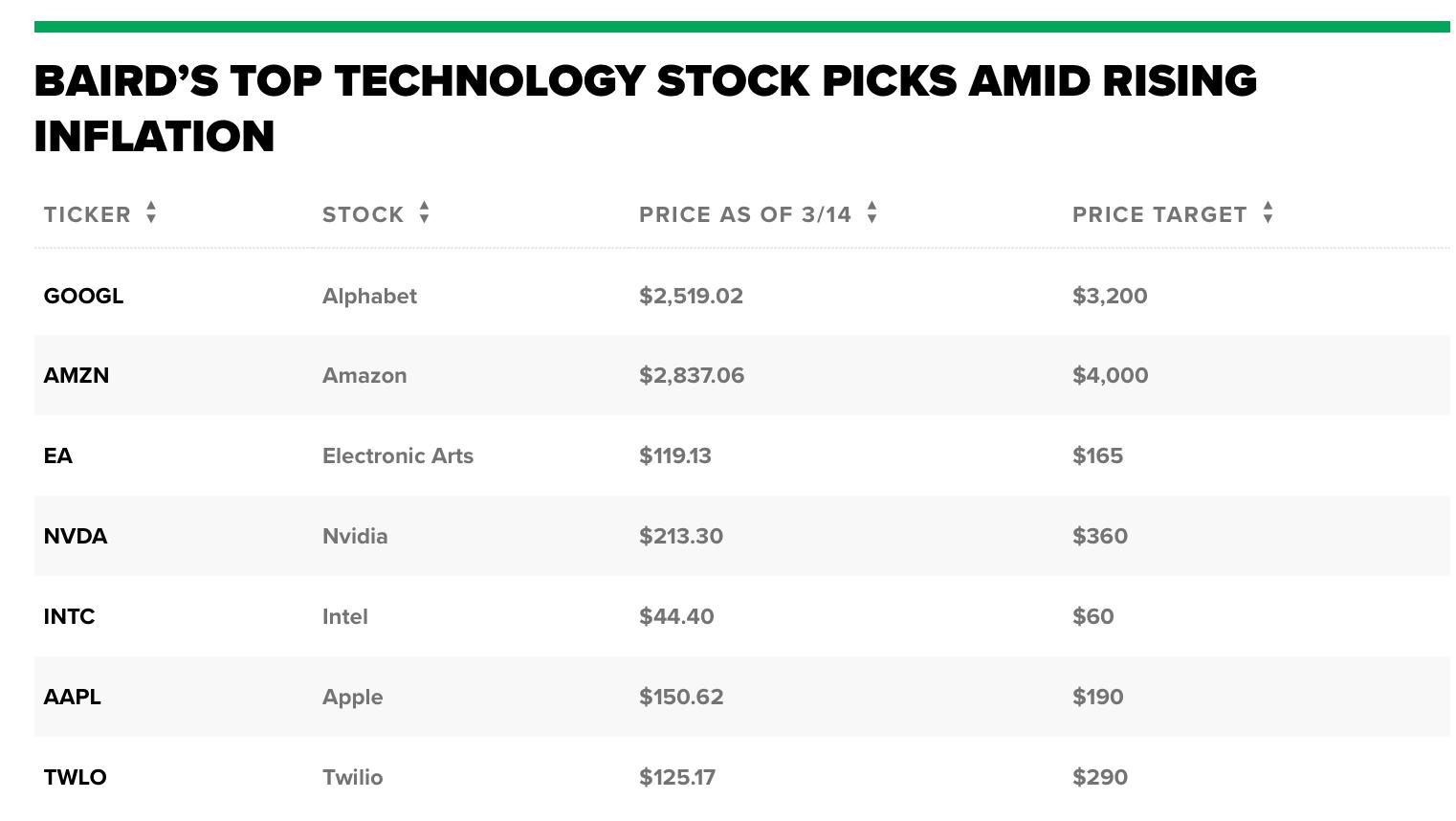

Technology Stocks (e.g., Apple, Microsoft, and Google's parent company, Alphabet): When the US dollar strengthens, technology stocks often benefit. This is because many technology companies generate a significant portion of their revenue from overseas, where they sell their products at higher prices due to the stronger dollar. As a result, their profits can increase when converted back to US dollars.

Energy Stocks (e.g., ExxonMobil and Chevron): The energy sector is highly sensitive to the US dollar's movements. A stronger dollar can make energy exports more expensive, potentially lowering the prices of oil and natural gas. However, companies with significant operations in the US can benefit from higher prices when the dollar strengthens.

Financial Stocks (e.g., JPMorgan Chase and Bank of America): Financial stocks can also be affected by the US dollar's movements. When the dollar strengthens, financial institutions may see an increase in net interest income, as the cost of borrowing money in foreign currencies decreases.

Stocks to Watch When the US Dollar Weakens

Consumer Discretionary Stocks (e.g., Walmart and Target): A weaker US dollar can make imported goods more expensive, potentially benefiting companies that sell domestically produced goods. Consumer discretionary stocks, particularly those focused on everyday essentials, can see increased sales and profitability.

Materials Stocks (e.g., Caterpillar and Rio Tinto): A weaker US dollar can make raw materials more expensive, benefiting companies that produce and sell these materials. Materials stocks can see increased demand and higher prices when the dollar weakens.

International Stocks (e.g., Procter & Gamble and McDonald's): International companies with significant exposure to foreign markets can benefit from a weaker US dollar. When the dollar weakens, their profits in foreign currencies can be converted into more US dollars, boosting their overall earnings.

Case Study: Apple

Consider Apple, a leading technology company with a significant portion of its revenue generated from overseas. When the US dollar strengthens, Apple's overseas revenue is converted into more US dollars, leading to higher profits. Conversely, when the dollar weakens, Apple's overseas revenue is converted into fewer US dollars, potentially impacting its profitability.

In conclusion, understanding the relationship between stocks and the US dollar is essential for investors looking to navigate the complex world of finance. By analyzing the impact of the US dollar on various sectors and individual stocks, investors can make more informed decisions and potentially enhance their portfolios.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....