In the ever-evolving landscape of the stock market, the question of whether it's a good time to buy US stocks is a topic that has sparked numerous debates among investors and financial experts. As we delve into the current market conditions, it's essential to analyze various factors that can influence this decision. This article aims to provide a comprehensive overview to help you make an informed decision.

Economic Stability and Growth

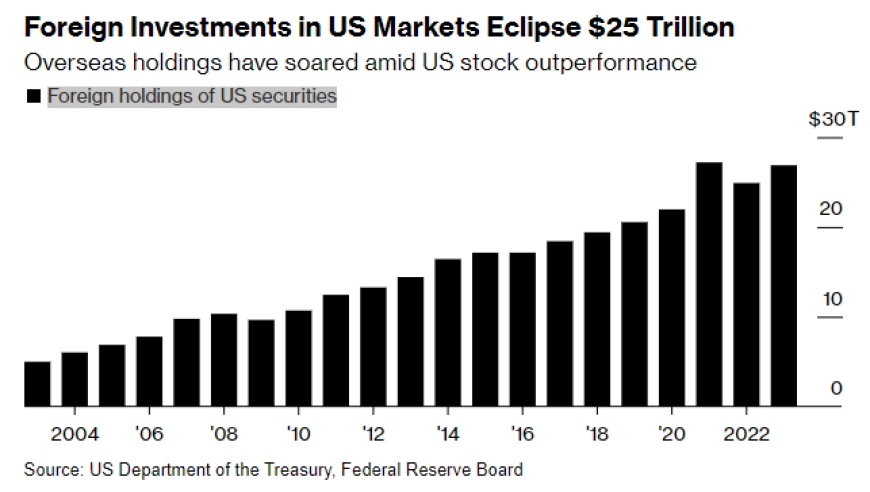

One of the primary factors to consider when evaluating the market's attractiveness is the state of the economy. The United States has traditionally been a stable and growing economy, making it an appealing destination for investors. Over the past few years, the country has experienced robust economic growth, driven by factors such as low unemployment rates and increasing consumer spending.

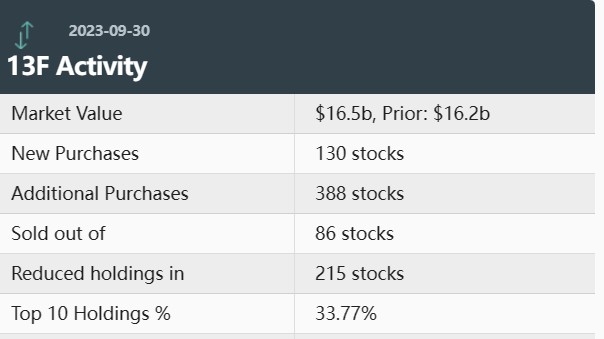

Sector Performance

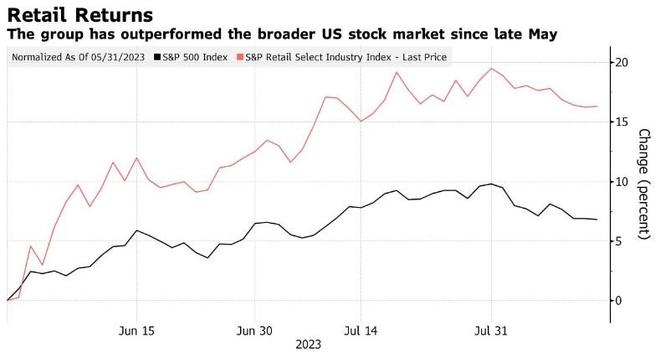

Another crucial aspect to consider is the performance of different sectors within the US stock market. Historically, sectors such as technology, healthcare, and consumer discretionary have outperformed the market. However, it's important to conduct thorough research to identify sectors that are poised for growth in the current market environment.

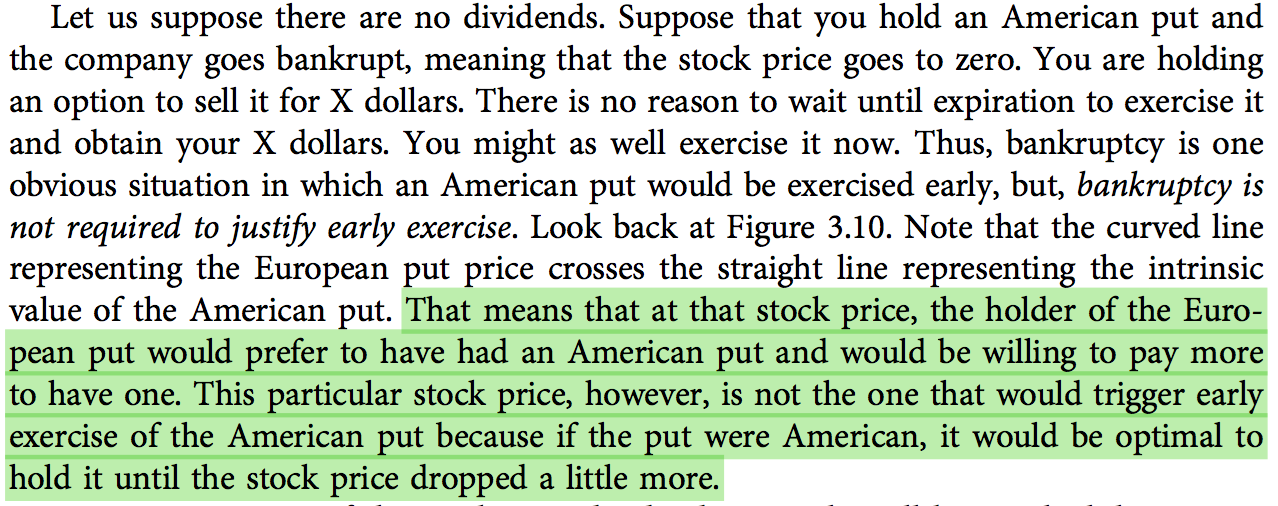

Stock Valuations

Stock valuations play a significant role in determining whether it's a good time to buy. A commonly used metric for assessing stock valuations is the price-to-earnings (P/E) ratio. A P/E ratio below 15 is generally considered undervalued, while a ratio above 20 is often seen as overvalued. As of the latest data, the US stock market is currently trading at a moderate P/E ratio, indicating that some stocks may be undervalued.

Market Trends

Analyzing market trends can provide valuable insights into potential investment opportunities. For instance, the rise of remote work has led to increased demand for cloud computing and cybersecurity services. Similarly, the growing focus on sustainability has driven interest in renewable energy and clean technology stocks.

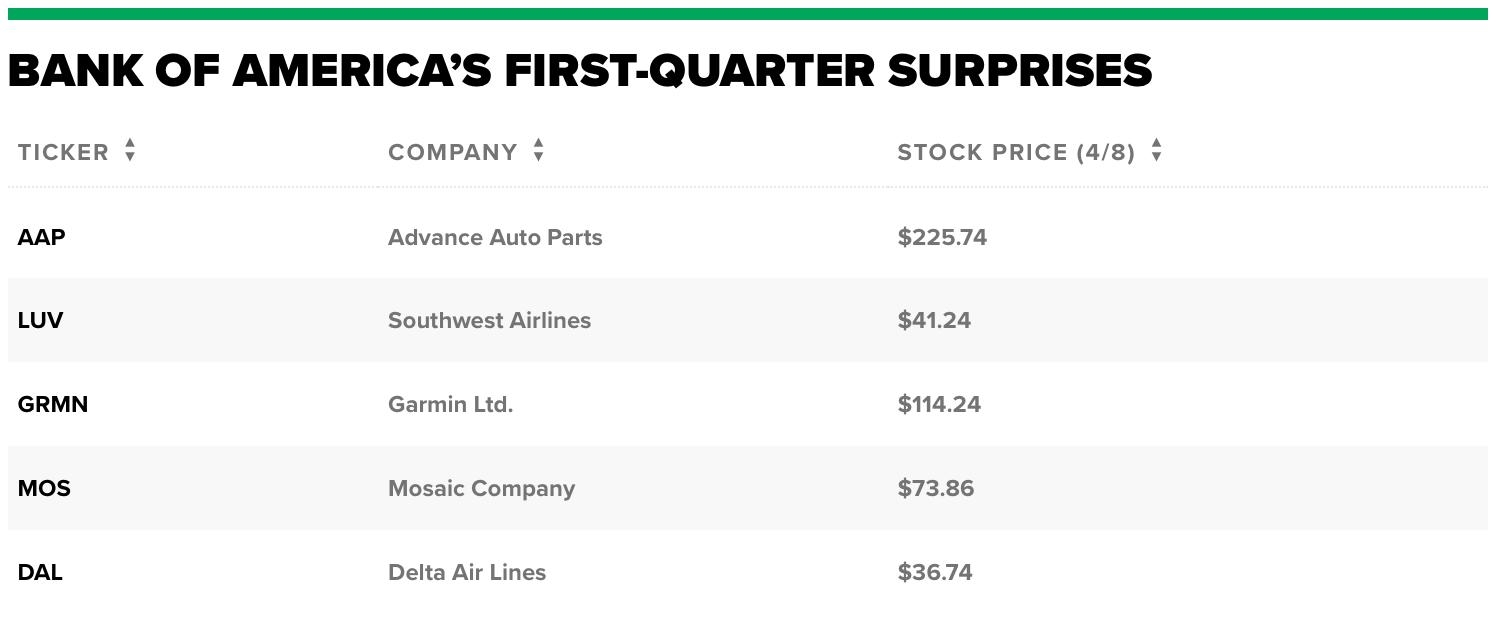

Case Studies

To illustrate the potential of investing in US stocks, let's consider a few case studies:

- Tesla, Inc. (TSLA): This electric vehicle manufacturer has seen remarkable growth over the past few years, with its stock price skyrocketing. Investors who bought Tesla's stock early on have reaped significant returns.

- Amazon.com, Inc. (AMZN): As one of the leading e-commerce platforms, Amazon has consistently delivered strong financial results. Its stock has also experienced substantial growth, making it an attractive investment for many.

Conclusion

In conclusion, while there are no guarantees in the stock market, the current economic conditions, sector performance, stock valuations, and market trends suggest that it may be a good time to consider buying US stocks. However, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions. As always, investing involves risks, and it's essential to proceed with caution.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....