The stock market is a reflection of the economic health of a country, and investors often look to the United States as a bellwether for global market trends. With that in mind, it's natural to wonder: if US stocks crash, will Canadian stocks crash too? In this article, we'll delve into the relationship between the US and Canadian stock markets, examining the factors that could lead to a synchronized downturn.

Understanding the Link Between US and Canadian Stock Markets

The US and Canadian stock markets are deeply interconnected. Many Canadian companies operate in the US, and vice versa, leading to a high degree of correlation between the two markets. Additionally, the Canadian economy is closely tied to the US economy, as the two countries share a large trade relationship.

Factors Influencing Stock Market Performance

Several factors can influence stock market performance, and some of these factors may contribute to a synchronized downturn in both the US and Canadian markets. Here are some key factors to consider:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can impact investor confidence and lead to stock market volatility.

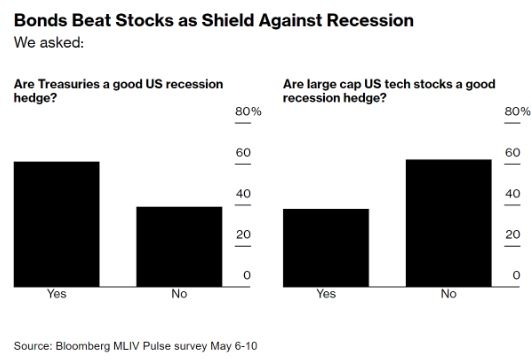

- Interest Rates: Central banks, like the Federal Reserve and the Bank of Canada, have the power to influence stock market performance by adjusting interest rates.

- Political Events: Political events, such as elections or changes in government policies, can create uncertainty in the market and lead to volatility.

- International Trade: Changes in international trade agreements or tariffs can impact the performance of companies in both countries.

The US Stock Market Crash of 2008 as a Case Study

One of the most notable examples of a synchronized downturn between the US and Canadian stock markets is the 2008 financial crisis. When the US stock market crashed, Canadian stocks followed suit. This was due to a combination of factors, including the interconnectedness of the two markets, the global nature of the financial crisis, and the close economic relationship between the US and Canada.

The Current Economic Landscape

Today, the US and Canadian stock markets are facing a complex economic landscape. While the US economy is currently experiencing strong growth, the Canadian economy is facing challenges such as a slowing housing market and trade tensions with the US. This could lead to a divergence in stock market performance between the two countries.

What Investors Should Know

Investors should be aware that while there is a correlation between the US and Canadian stock markets, this does not guarantee a synchronized downturn. It's important to consider individual company fundamentals, industry trends, and economic indicators when making investment decisions.

Conclusion

In conclusion, while a crash in the US stock market could potentially lead to a downturn in the Canadian stock market, it's not a foregone conclusion. Investors should stay informed about the economic landscape and consider a diversified portfolio to mitigate risk. By understanding the factors that influence stock market performance, investors can make more informed decisions and navigate the complexities of the global stock market.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....