In October 2025, the US stock market continues to be a focal point for investors and financial analysts. With the market facing a myriad of factors, including economic indicators, geopolitical tensions, and technological advancements, understanding the current trends and predictions is crucial. This article delves into the latest analysis of the US stock market, highlighting key trends, sectors, and potential risks.

Market Overview

The US stock market has seen a rollercoaster ride in recent years, with volatility being the norm. As of October 2025, the market is experiencing a period of consolidation, with investors weighing various factors. The S&P 500, a widely followed benchmark index, has seen a modest increase, driven by strong corporate earnings and a recovering economy.

Sector Analysis

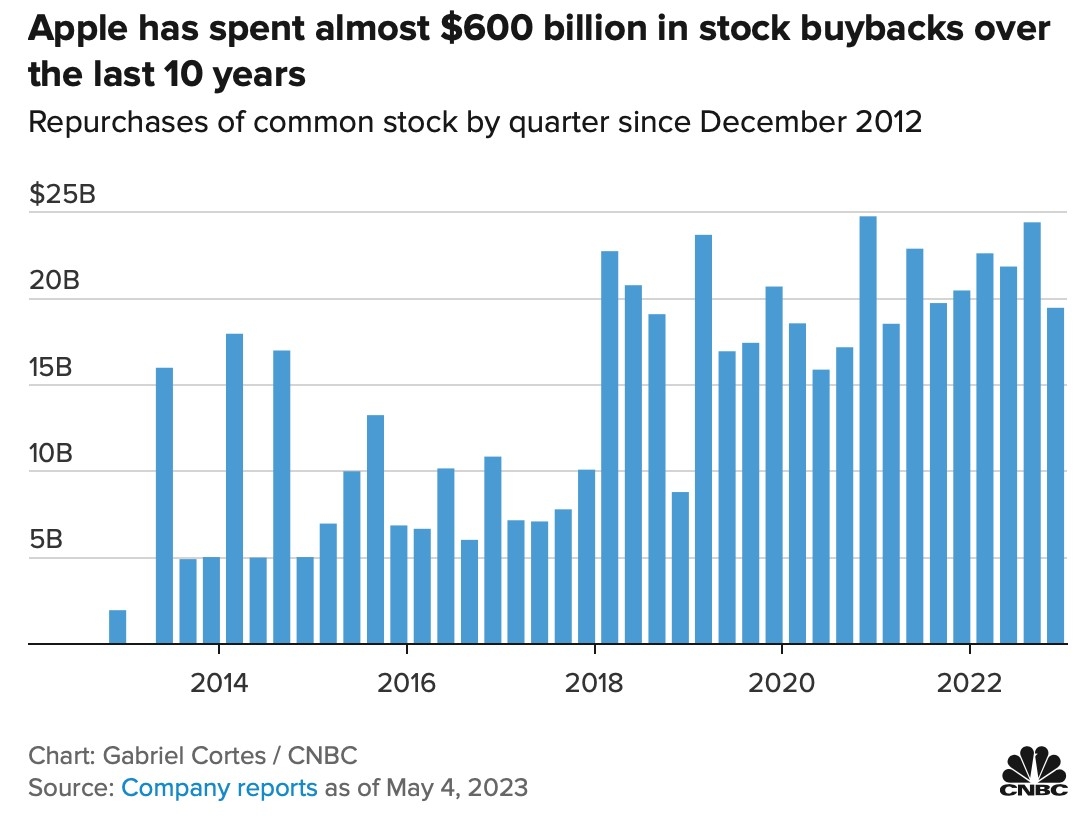

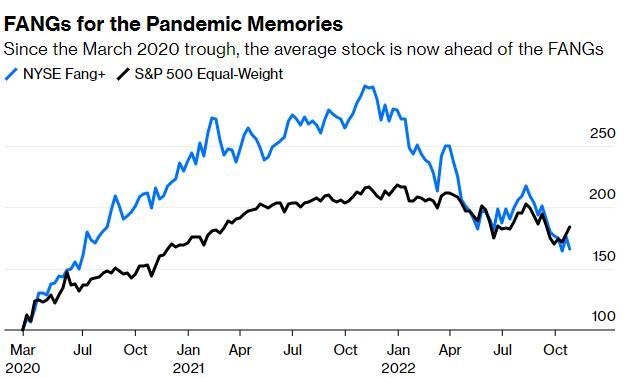

Several sectors have emerged as winners in the current market environment. Technology remains a dominant force, with companies like Apple, Microsoft, and Amazon leading the pack. The rise of remote work and digital transformation has fueled growth in this sector, making it a safe bet for investors.

Financials and Energy

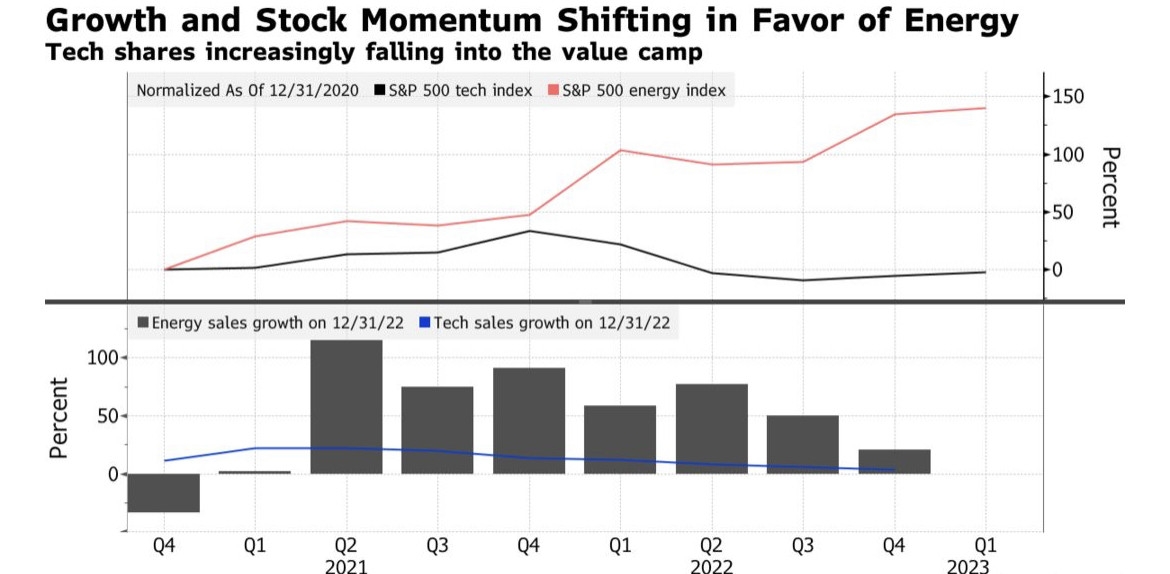

The financial sector has also seen significant growth, driven by low interest rates and a recovering economy. Banks and insurance companies have reported strong earnings, leading to an increase in their stock prices. Additionally, the energy sector has made a comeback, with oil prices stabilizing and natural gas reserves increasing.

Emerging Risks

While the market is performing well, there are several emerging risks that investors should be aware of. Geopolitical tensions, particularly in Eastern Europe, could lead to supply chain disruptions and higher inflation. Additionally, rising interest rates could impact the profitability of companies, particularly in the technology sector.

Technological Advancements

The rapid pace of technological advancements continues to reshape the market. Artificial intelligence, blockchain, and quantum computing are some of the emerging technologies that are expected to disrupt various industries. Investors should stay informed about these advancements and consider investing in companies that are at the forefront of innovation.

Case Studies

One notable case study is the rise of electric vehicle (EV) manufacturers. Companies like Tesla and Nikola have seen their stock prices soar, driven by increasing demand for sustainable transportation. This trend is expected to continue as more consumers and businesses adopt EVs, leading to significant growth in the sector.

Conclusion

As of October 2025, the US stock market is performing well, with technology and financial sectors leading the charge. However, investors should remain cautious and stay informed about emerging risks and technological advancements. By doing so, they can make informed decisions and navigate the volatile market landscape.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....