In 2019, investors faced a critical decision: should they invest in emerging markets or US stocks? This article delves into the key factors that influenced this decision, providing a comprehensive analysis of both options. By the end of this read, you'll be equipped with the knowledge to make an informed investment choice.

Emerging Markets: The Rising Stars

Emerging markets, such as China, India, and Brazil, have been making waves in the global investment landscape. These countries are experiencing rapid economic growth, driven by factors like population growth, urbanization, and technological advancements.

Key Factors Attracting Investors to Emerging Markets:

- Rapid Economic Growth: Emerging markets are growing at a faster pace than developed countries, offering significant potential for capital appreciation.

- Population Growth: A growing population translates to a larger workforce, which can drive economic growth and increase demand for goods and services.

- Urbanization: As people move from rural to urban areas, there is a surge in demand for infrastructure, housing, and consumer goods.

- Technological Advancements: Emerging markets are rapidly adopting new technologies, creating new opportunities for investment.

US Stocks: The Time-Tested Choice

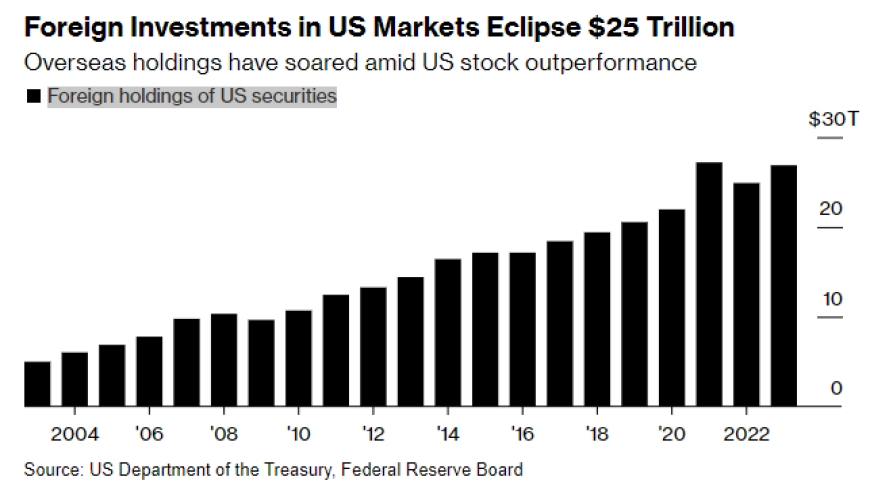

On the other hand, US stocks have long been a popular choice for investors. The US stock market is the largest and most liquid in the world, offering a wide range of investment opportunities.

Key Factors Attracting Investors to US Stocks:

- Stable Economic Environment: The US has a stable political and economic environment, which is conducive to business growth.

- Innovative Companies: The US is home to some of the world's most innovative companies, which are driving economic growth and creating new opportunities.

- Diversified Market: The US stock market is highly diversified, offering exposure to various sectors and industries.

- Strong Regulatory Framework: The US has a strong regulatory framework that protects investors and ensures fair trading practices.

Comparative Analysis:

To make a well-informed decision, it's essential to compare the pros and cons of investing in emerging markets versus US stocks.

Pros of Investing in Emerging Markets:

- Higher Potential Returns: Emerging markets offer higher potential returns compared to developed countries.

- Diversification: Investing in emerging markets can help diversify your portfolio and reduce risk.

- Long-Term Growth: Emerging markets have a long-term growth potential, making them an attractive investment option.

Cons of Investing in Emerging Markets:

- Political and Economic Risk: Emerging markets are subject to political and economic instability, which can impact investment returns.

- Currency Risk: Currency fluctuations can impact the returns on investments in emerging markets.

- Regulatory Risk: Emerging markets may have less stringent regulatory frameworks, which can increase the risk of investment losses.

Pros of Investing in US Stocks:

- Stable Returns: US stocks have historically provided stable returns, making them a reliable investment option.

- Diversification: The US stock market is highly diversified, offering exposure to various sectors and industries.

- Regulatory Framework: The US has a strong regulatory framework that protects investors and ensures fair trading practices.

Cons of Investing in US Stocks:

- Lower Potential Returns: US stocks may offer lower potential returns compared to emerging markets.

- Market Volatility: The US stock market can be volatile, especially during economic downturns.

Conclusion:

In 2019, the decision between investing in emerging markets or US stocks was a challenging one. Both options offer unique advantages and disadvantages. Ultimately, the choice depends on your investment goals, risk tolerance, and market outlook. By understanding the key factors that influence this decision, you can make an informed investment choice that aligns with your financial objectives.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....