Introduction:

The concept of the U.S. government issuing stocks might sound unconventional, but it's a topic that has sparked significant interest and debate. Can the federal government, a non-profit entity, really issue stocks to the public? In this article, we will delve into this intriguing question and explore the possibilities, complexities, and potential impacts of such a move.

Understanding the Concept of Stocks

To begin with, let's clarify what stocks are. Stocks represent ownership in a company and provide shareholders with certain rights, such as voting and dividend payments. When a company issues stocks, it is essentially selling a portion of its ownership to investors.

However, the U.S. government is a non-profit entity that operates on tax revenue rather than profit. Its primary goal is to provide public services and maintain national security, rather than generating profits. This raises the question: Can the U.S. government issue stocks, and if so, what would be the implications?

Can the US Govt Issue Stocks?

Technically, the U.S. government cannot issue stocks in the traditional sense, as it is not a for-profit entity. However, there are alternative ways in which the government could raise funds through a stock-like instrument.

Government-Backed Securities: The U.S. government has already issued various types of securities, such as Treasury bills, notes, and bonds. These securities are essentially loans from investors to the government, and they pay interest to the holders. While these are not stocks, they serve a similar purpose of providing investors with a return on their investment.

Special Purpose Entities (SPEs): The government could create special purpose entities to issue stocks-like securities. These entities would be designed to fund specific projects or programs, and their shares could be traded on exchanges. For example, a government could establish an SPE to finance infrastructure development and issue shares to investors, who would then benefit from the project's success.

Public-Private Partnerships (PPPs): The government could also form partnerships with private entities to fund projects. In this scenario, the private entity would issue stocks, and the government would have a stake in the project through its partnership.

Case Study: China's State-Owned Enterprises (SOEs)

To provide some context, China has a long history of state-owned enterprises (SOEs) that issue stocks. These SOEs are government-owned and operate as for-profit entities. They issue stocks to the public, allowing the government to raise capital for various projects and programs. This model has enabled China to finance significant infrastructure development and industrial growth.

The Potential Implications of Government Stocks

If the U.S. government were to issue stocks-like securities, there would be several potential implications:

Funding for Public Projects: Issuing stocks could provide the government with a new source of funding for public projects, potentially reducing the need for borrowing or raising taxes.

Investor Diversification: Investors would have the opportunity to diversify their portfolios with government-backed securities, which could increase market liquidity.

Market Stability: The government could use the proceeds from stock-like securities to stabilize the economy during times of financial distress.

However, there are also potential drawbacks to consider:

Market Manipulation: There is a risk that the government could manipulate stock prices through its influence over the entities issuing stocks.

Political Influence: The government's involvement in the stock market could raise concerns about political influence over financial markets.

In conclusion, while the U.S. government cannot issue stocks in the traditional sense, there are alternative ways to raise funds through stock-like securities. The potential implications of such a move are significant, and further research and analysis are needed to determine the feasibility and impact of this approach.

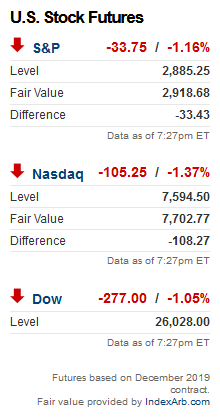

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....