In the vast landscape of global finance, the stock markets of the United States and Japan stand as two of the most influential and significant. While both are key components of the global economy, they operate in distinct ways, shaped by their unique cultural, regulatory, and economic landscapes. This article delves into the key differences between the US and Japan stock markets, highlighting their unique characteristics and implications for investors.

Market Structure and Regulation

One of the most prominent differences between the US and Japan stock markets is the regulatory framework. The US markets are governed by the Securities and Exchange Commission (SEC), which enforces strict regulations to ensure fair and transparent trading. In contrast, Japan's stock market is regulated by the Financial Services Agency (FSA), which also enforces rigorous regulations but with a slightly different approach.

Trading Hours and Days

The trading hours in the US and Japan also differ. The New York Stock Exchange (NYSE) and the NASDAQ operate from 9:30 AM to 4:00 PM Eastern Time, while the Tokyo Stock Exchange (TSE) operates from 9:00 AM to 3:30 PM Japan Standard Time. This difference can impact the liquidity of certain stocks, as trading in one market may be closed when trading in the other market is open.

Market Capitalization and Composition

The composition of the US and Japan stock markets also varies significantly. The US market is home to a diverse range of companies across various sectors, including technology, healthcare, and finance. The TSE, on the other hand, is heavily dominated by companies in the manufacturing and automotive sectors, reflecting Japan's historical economic focus.

Dividend Yield and Stock Performance

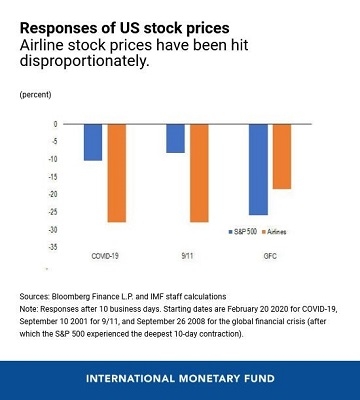

Another key difference lies in dividend yield and stock performance. The US stock market typically offers higher dividend yields compared to Japan. This is due to a variety of factors, including tax policies and the stage of the economic cycle in each country. Additionally, the performance of stocks in the US and Japan can differ significantly, as each market reacts to different economic and political events.

Investor Sentiment and Behavior

Investor sentiment and behavior also play a crucial role in shaping the US and Japan stock markets. The US market is known for its volatility, with investors often reacting quickly to economic data and political news. In contrast, the Japanese market is generally more stable, with investors taking a longer-term approach to investing.

Case Study: Tesla and Toyota

To illustrate these differences, consider the case of Tesla and Toyota. Tesla, a US-based electric vehicle manufacturer, is listed on the NASDAQ and is known for its high stock volatility and innovative technology. In contrast, Toyota, a Japanese multinational automotive manufacturer, is listed on the TSE and is known for its stability and long-standing reputation in the automotive industry.

Conclusion

The US and Japan stock markets offer unique opportunities and challenges for investors. Understanding these differences can help investors make informed decisions and capitalize on the strengths of each market. Whether you're a seasoned investor or just starting out, recognizing the distinctive characteristics of these markets is crucial for achieving your investment goals.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....