Introduction

Investing in international stocks can be a lucrative venture, especially for investors looking to diversify their portfolios. One of the most attractive markets for US investors is Canada. With its strong economy, stable political environment, and numerous high-performing companies, Canada offers a wealth of opportunities. This article will explore the process of investing in Canadian stocks from the United States, providing you with valuable insights and tips to make informed decisions.

Understanding the Canadian Stock Market

The Canadian stock market is one of the largest in the world, with a diverse range of industries and companies. The Toronto Stock Exchange (TSX) and the Vancouver Stock Exchange (VSE) are the two main exchanges where Canadian stocks are traded. These exchanges offer a wide array of investment options, including stocks, bonds, and exchange-traded funds (ETFs).

Benefits of Investing in Canadian Stocks

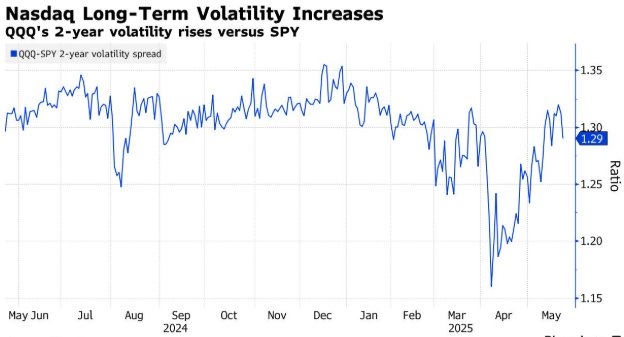

- Diversification: Investing in Canadian stocks can help you diversify your portfolio, reducing exposure to market volatility and potential losses.

- Strong Economy: Canada boasts a robust economy, driven by industries such as energy, technology, and finance. This stability makes it an attractive destination for investors.

- High-Quality Companies: Canada is home to numerous high-performing companies, including some of the world's largest mining companies, energy producers, and technology firms.

- Currency Fluctuations: Investing in Canadian stocks can offer exposure to currency fluctuations, which can be beneficial if the Canadian dollar strengthens against the US dollar.

How to Invest in Canadian Stocks from the US

- Open a Canadian Brokerage Account: The first step is to open a brokerage account with a Canadian brokerage firm. Many Canadian brokerage firms offer services to US investors, making it easy to trade Canadian stocks.

- Research and Analyze: Conduct thorough research on Canadian companies before investing. Analyze their financial statements, business models, and industry position to make informed decisions.

- Understand Risk Factors: Be aware of the risks associated with investing in Canadian stocks, such as currency fluctuations, political instability, and economic downturns.

- Use ETFs and Mutual Funds: Consider investing in Canadian ETFs and mutual funds, which offer diversification and professional management. This can be a more accessible option for investors with limited knowledge of the Canadian market.

Case Study: Investing in Canadian Energy Stocks

One of the most popular sectors among US investors is the Canadian energy sector. Companies like Suncor Energy and Canadian Natural Resources offer exposure to the oil and gas industry. However, investing in this sector comes with its own set of risks, such as volatile commodity prices and environmental concerns.

To mitigate these risks, consider investing in a diversified energy ETF or mutual fund that includes a mix of Canadian and international energy companies. This approach can help reduce exposure to specific companies and sectors, providing a more balanced investment strategy.

Conclusion

Investing in Canadian stocks from the US can be a rewarding venture, offering diversification and exposure to a stable and growing economy. By understanding the Canadian stock market, conducting thorough research, and considering risk factors, you can make informed decisions and potentially achieve significant returns. Remember to consult with a financial advisor before making any investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....