The United States is home to the world's largest and most influential stock exchanges. These markets provide a platform for investors to buy and sell stocks of public companies, which are traded in billions of dollars each day. But how many stocks actually trade on US exchanges? Let's delve into this fascinating question.

Understanding US Stock Exchanges

The United States has several major stock exchanges, including the New York Stock Exchange (NYSE), the Nasdaq Stock Market, and the American Stock Exchange (AMEX). Each of these exchanges has its unique characteristics and lists a variety of companies across different industries.

The New York Stock Exchange (NYSE) is the oldest and most well-known exchange in the United States. It's where some of the world's largest and most influential companies, like General Electric, Johnson & Johnson, and Bank of America, are listed. The NYSE is also the exchange that trades the most stocks.

The Nasdaq Stock Market is a relatively newer exchange, having been established in the 1970s. It is known for listing high-tech companies and has become a major destination for tech giants such as Apple, Microsoft, and Google.

The American Stock Exchange (AMEX), while less prominent than the NYSE and Nasdaq, still has a significant presence. It is particularly popular with smaller companies looking to raise capital.

The Number of Stocks Traded on US Exchanges

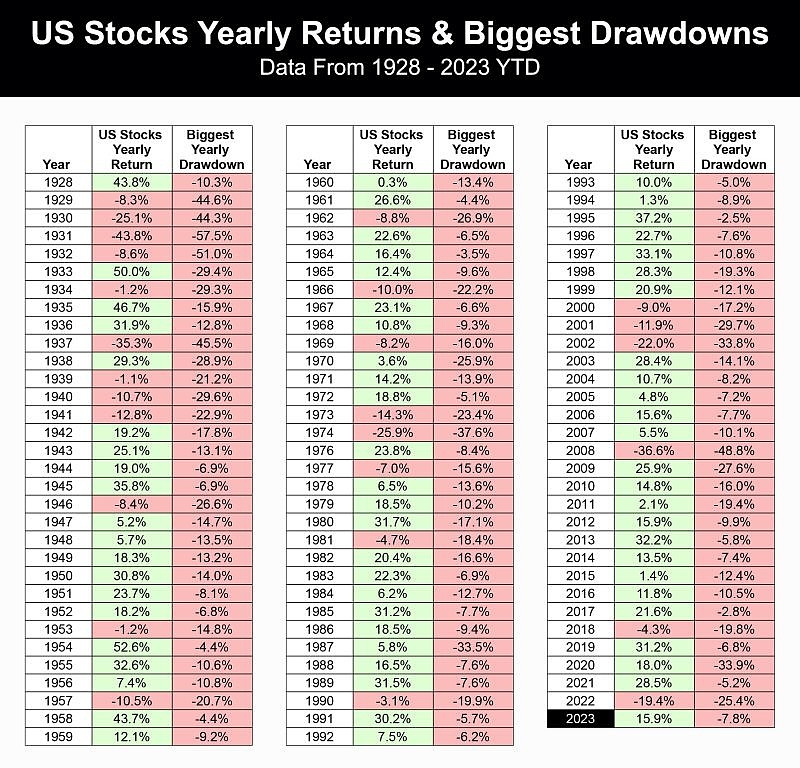

Determining the exact number of stocks traded on US exchanges can be a bit challenging. However, as of 2021, it is estimated that there are over 13,000 stocks listed on these exchanges. This number is constantly changing as companies go public, are delisted, or merge with others.

Factors Influencing the Number of Stocks

Several factors can influence the number of stocks traded on US exchanges. Here are some of the key drivers:

- Initial Public Offerings (IPOs): When a company decides to go public, it issues new shares to the public through an IPO. This often increases the number of stocks available on exchanges.

- Mergers and Acquisitions: When companies merge or are acquired, their stocks may be delisted or consolidated, which can also affect the number of stocks available.

- Delisting: Some companies may choose to delist from exchanges due to poor performance or other reasons, which can also impact the number of stocks available.

- Market Volatility: During times of market volatility, companies may decide to go public or delist, which can lead to fluctuations in the number of stocks available.

Case Study: Tesla's IPO

A notable case study is the initial public offering (IPO) of Tesla, Inc. in June 2018. The electric vehicle company raised $17.2 billion through the IPO, becoming one of the largest IPOs in US history. As a result, Tesla's stock was listed on the Nasdaq Stock Market, contributing to the number of stocks available for trading.

Conclusion

In conclusion, the number of stocks traded on US exchanges is a dynamic figure, influenced by various factors such as IPOs, mergers and acquisitions, and delisting. As of 2021, there are over 13,000 stocks available for trading on US exchanges. This vast number reflects the vibrancy and diversity of the American stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....