The recent US government shutdown has sent ripples through the global financial markets, with European stocks taking a hit. This article delves into how the shutdown has impacted European markets and the implications for investors.

Understanding the US Government Shutdown

The US government shutdown, which began on December 22, 2018, was a result of a budget impasse between the White House and Congress. The shutdown was the longest in US history, affecting over 800,000 federal employees and agencies.

Impact on European Markets

The shutdown has had a significant impact on European markets, with stocks experiencing volatility. Here's how:

Economic Uncertainty: The shutdown has raised concerns about the US economy's growth prospects. This uncertainty has led to a sell-off in European stocks, particularly those with significant exposure to the US market.

Currency Fluctuations: The US dollar has weakened due to the shutdown, making it more expensive for European investors to buy US stocks. This has put downward pressure on European stocks.

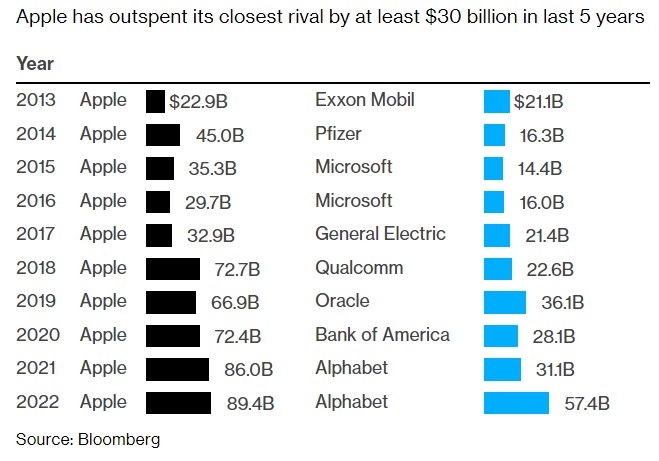

Sector-Specific Impacts: Certain sectors, such as technology and financials, have been hit hard due to their close ties with the US market. For example, tech giant Apple has seen its stock price decline as a result of the shutdown.

Key European Stocks Affected

Several key European stocks have been impacted by the US government shutdown. Here are a few examples:

Daimler AG: The German automaker has seen its stock price decline due to concerns about the US market's impact on its sales.

Bayer AG: The pharmaceutical giant has been affected by the shutdown, as it relies on US regulatory approvals for its products.

ASML Holding NV: The Dutch semiconductor equipment manufacturer has seen its stock price decline due to concerns about the impact of the shutdown on the US tech sector.

Case Study: Volkswagen AG

Volkswagen AG, the German automaker, is one of the companies most affected by the US government shutdown. The shutdown has led to concerns about the company's sales in the US, its largest market outside of Europe.

Volkswagen has seen its stock price decline by over 5% since the shutdown began. The company has also announced that it will cut production at several of its US plants due to the shutdown.

Conclusion

The US government shutdown has had a significant impact on European markets, with stocks experiencing volatility. Investors need to be aware of the potential risks associated with the shutdown and its implications for their portfolios. As the situation unfolds, it's essential to stay informed and make informed investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....