In recent years, the Chinese real estate giant Evergrande Group has captured the attention of investors worldwide, particularly those interested in US stocks. As the company's financial troubles continue to unfold, understanding the implications for its US-listed shares is crucial. This article delves into the key aspects of Evergrande's US stocks, providing investors with valuable insights into the potential risks and opportunities.

Understanding Evergrande's US Stock Market Presence

Evergrande Group, founded in 1996, is one of China's largest real estate developers. It operates in various segments, including property development, construction, and financial services. The company's shares are listed on the Hong Kong Stock Exchange (HKEX) and the New York Stock Exchange (NYSE) under the ticker symbol " Evergrande US stocks."

The Financial Troubles of Evergrande

Evergrande's financial troubles began to surface in 2021 when the company faced a liquidity crisis. As one of the most heavily indebted companies in the world, Evergrande struggled to meet its obligations, leading to concerns about its solvency. The situation escalated in September 2021 when the company missed a significant interest payment, prompting a sell-off in its US-listed shares.

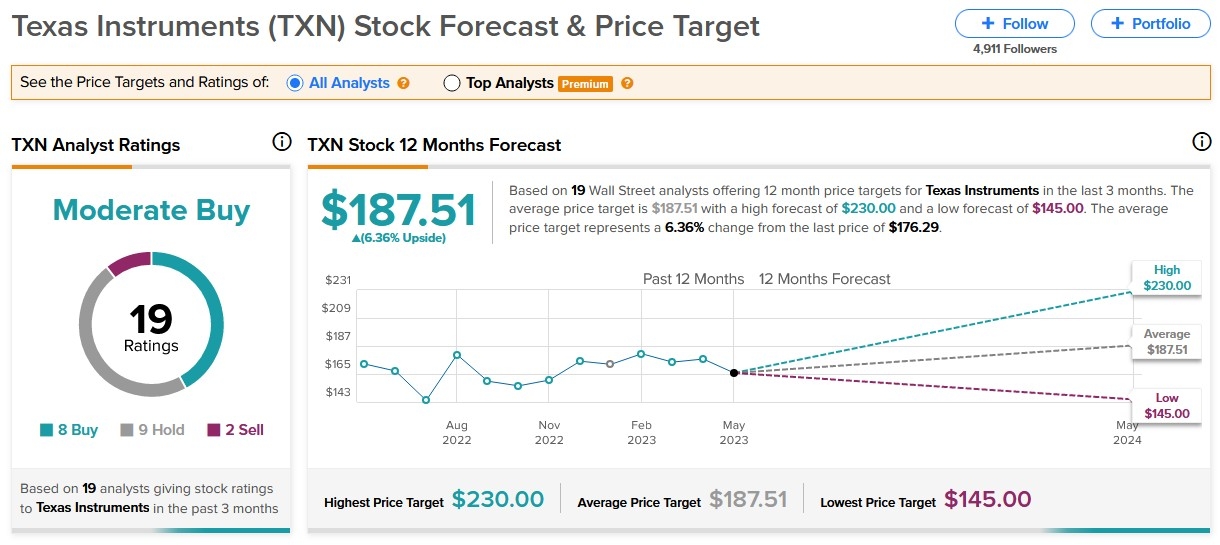

Impact on Evergrande US Stocks

The decline in Evergrande's US-listed shares has been significant, with the stock price plummeting by more than 90% from its peak. This decline has been driven by several factors, including the company's liquidity crisis, concerns about its ability to meet its obligations, and the broader impact on the Chinese real estate market.

Risks and Opportunities for Investors

For investors considering Evergrande US stocks, there are several key risks and opportunities to consider:

Risks

- Liquidity Crisis: The primary risk for investors is the ongoing liquidity crisis at Evergrande. If the company fails to resolve its financial issues, there could be significant losses for shareholders.

- Regulatory Risks: The Chinese government's intervention in the real estate market could impact Evergrande's operations and its ability to repay its debts.

- Market Sentiment: The stock's price is highly sensitive to market sentiment, which can be volatile due to the company's ongoing financial troubles.

Opportunities

- Potential Turnaround: If Evergrande manages to stabilize its financial situation, there could be a significant upside for investors.

- Dividends: Evergrande has historically paid dividends to its shareholders, which could be a potential source of returns for investors.

- Market Disruption: The company's struggles could create opportunities for other players in the Chinese real estate market.

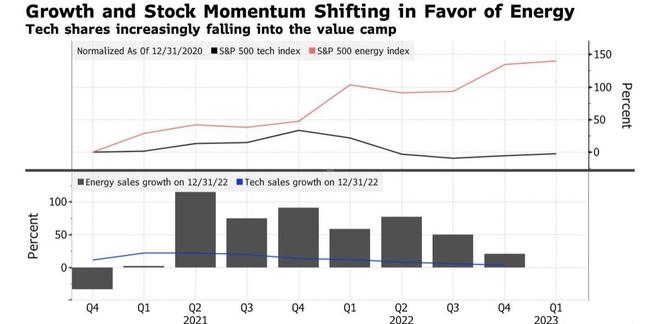

Case Study: The Impact of Evergrande's Financial Troubles on US Markets

One of the most notable impacts of Evergrande's financial troubles was the sell-off in the US stock market. In September 2021, the S&P 500 and the NASDAQ experienced significant declines, with investors reacting to the uncertainty surrounding Evergrande's future. This case study highlights the interconnectedness of global markets and the potential impact of a single company's financial troubles.

Conclusion

Investing in Evergrande US stocks is not without its risks, but it also presents potential opportunities. Understanding the company's financial situation, the risks involved, and the broader market context is crucial for investors considering this investment. As the situation evolves, staying informed and monitoring the company's progress will be key to making informed decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....