Investing in the stock market can be a daunting task, especially for beginners. With thousands of stocks to choose from, it's hard to know where to start. If you're looking for promising investment opportunities that won't break the bank, we've compiled a list of the best US stocks under $100. These companies are not only undervalued but also have strong fundamentals and growth potential.

1. Amazon (AMZN)

As one of the largest e-commerce platforms in the world, Amazon has revolutionized the way we shop. With a market cap of over

2. NVIDIA (NVDA)

NVIDIA is a leader in the semiconductor industry, specializing in graphics processing units (GPUs). The company's GPUs are used in a wide range of applications, from gaming to autonomous vehicles. With a market cap of over

3. Visa (V)

Visa is a global payments company that processes more than 65 billion transactions annually. The company has a strong market position and a diverse revenue stream, including transaction fees and card-based products. With a market cap of over

4. Adobe (ADBE)

Adobe is a leader in digital marketing and creative software, with a market cap of over

5. PayPal (PYPL)

PayPal is a digital payments platform that allows users to send and receive money online. The company has a strong market position and a growing user base, with over 350 million active accounts. PayPal has also expanded its services to include peer-to-peer payments, Venmo, and Braintree. With a market cap of over

Conclusion

Investing in the stock market can be a rewarding experience, but it's important to do your research. By focusing on companies with strong fundamentals and growth potential, you can build a diversified portfolio that generates long-term returns. The best US stocks under $100 listed above are excellent investment opportunities for investors looking to grow their wealth. Remember to do your own research and consult with a financial advisor before making any investment decisions.

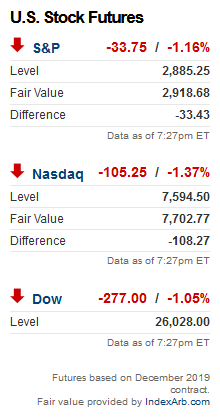

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....