In the ever-evolving world of finance, the stock market is a dynamic landscape where trends can shift rapidly. One such shift has recently been observed as US stock futures took a downturn, primarily due to the fading performance of tech stocks. This article delves into the reasons behind this decline and its potential implications for the broader market.

The Tech Stock Downturn

The tech sector has long been a driving force behind the US stock market's growth. However, recent developments have led to a notable decline in tech stocks, which has had a ripple effect on the broader market. Several factors have contributed to this downturn:

- Economic Concerns: The global economy has been facing challenges, including rising inflation and supply chain disruptions. These concerns have led investors to seek safer investments, pushing tech stocks lower.

- Valuation Concerns: Tech stocks have been on a rollercoaster ride in recent years, with their valuations often reaching sky-high levels. As investors become more cautious, they are questioning the sustainability of these valuations, leading to a sell-off.

- Regulatory Changes: The tech industry has faced increased scrutiny from regulators in recent years. These regulatory changes have raised concerns about the future growth prospects of tech companies, further contributing to the downturn.

Impact on US Stock Futures

The downturn in tech stocks has had a significant impact on US stock futures. As these stocks are a major component of the market, their decline has caused the overall market to weaken. This can be seen in the following ways:

- Falling Futures: US stock futures have been falling, indicating a bearish outlook for the market. This decline is primarily driven by the fading performance of tech stocks.

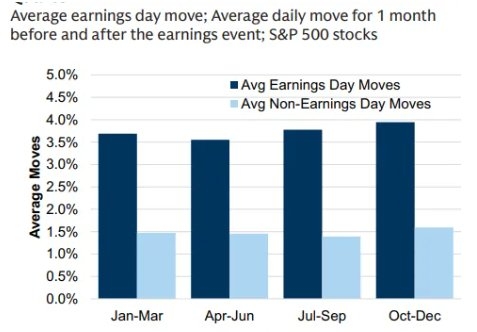

- Increased Volatility: The market has become more volatile, with sharp swings in prices. This volatility is likely to continue as investors grapple with the challenges facing the tech sector.

Case Studies

To better understand the impact of the tech stock downturn, let's look at a couple of case studies:

- Facebook (Meta): Facebook, now known as Meta, has been one of the hardest-hit tech stocks. The company's stock has fallen significantly in recent months, as investors question its long-term growth prospects. This decline has had a ripple effect on the broader market, contributing to the downturn in US stock futures.

- Tesla: Tesla, another major tech stock, has also faced challenges. The company's stock has been volatile, with sharp ups and downs. This volatility has contributed to the overall uncertainty in the market, further exacerbating the downturn in tech stocks.

Conclusion

The recent downturn in tech stocks has had a significant impact on US stock futures. As investors grapple with economic concerns, valuation concerns, and regulatory changes, the tech sector is facing a challenging environment. This downturn is likely to continue, with potential implications for the broader market. As always, it's important for investors to stay informed and make informed decisions based on their own risk tolerance and investment goals.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....