In the ever-evolving world of finance, stock index charts play a crucial role in analyzing market trends and making informed investment decisions. This guide will delve into the intricacies of US stock index charts, highlighting their significance, key features, and how to interpret them effectively.

The Significance of US Stock Index Charts

US stock index charts are essential tools for investors, traders, and analysts seeking to understand the overall market's direction and identify potential opportunities. By tracking the performance of a basket of stocks, these charts provide a snapshot of the market's health and help investors gauge market sentiment.

Key Features of US Stock Index Charts

Index Composition: US stock index charts typically include a diverse range of companies across various sectors. The most widely followed indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Time Frames: Charts can be viewed over different time frames, such as daily, weekly, monthly, or even yearly. This allows investors to analyze short-term or long-term trends.

Price and Volume: The price chart displays the index's value over time, while the volume chart shows the number of shares traded. These two components are crucial for understanding market dynamics.

Technical Indicators: Various technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), are used to analyze the stock index's performance.

Interpreting US Stock Index Charts

Trends: Look for upward or downward trends in the price chart. An upward trend indicates a bullish market, while a downward trend suggests bearish sentiment.

Support and Resistance Levels: Identify key support and resistance levels, which are critical price points where the stock index is likely to reverse direction.

Candlestick Patterns: Analyze candlestick patterns, such as doji, hammers, and engulfing patterns, to predict potential market movements.

Technical Indicators: Interpret the signals generated by technical indicators to gain insights into the market's direction.

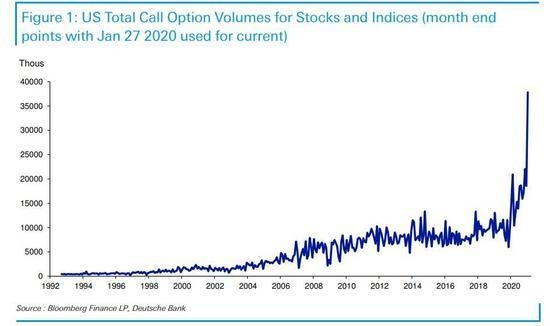

Case Study: The 2020 Stock Market Crash

The 2020 stock market crash serves as an excellent example of how to use US stock index charts to analyze market trends. As the COVID-19 pandemic unfolded, the S&P 500 experienced a sharp decline, reaching a low of 2,237.40 on March 23, 2020. However, as the situation improved and the economy started to recover, the index began to rise, reaching a high of 4,796.56 by the end of the year.

By analyzing the stock index chart during this period, investors could have identified the bearish trend and taken appropriate measures to protect their portfolios. As the market started to recover, they could have capitalized on the upward trend by investing in stocks or other financial instruments.

Conclusion

Understanding US stock index charts is essential for anyone looking to navigate the complex world of finance. By analyzing trends, support and resistance levels, and technical indicators, investors can make informed decisions and potentially capitalize on market opportunities. Remember, the key to successful investing lies in continuous learning and adapting to changing market conditions.

new york stock exchange

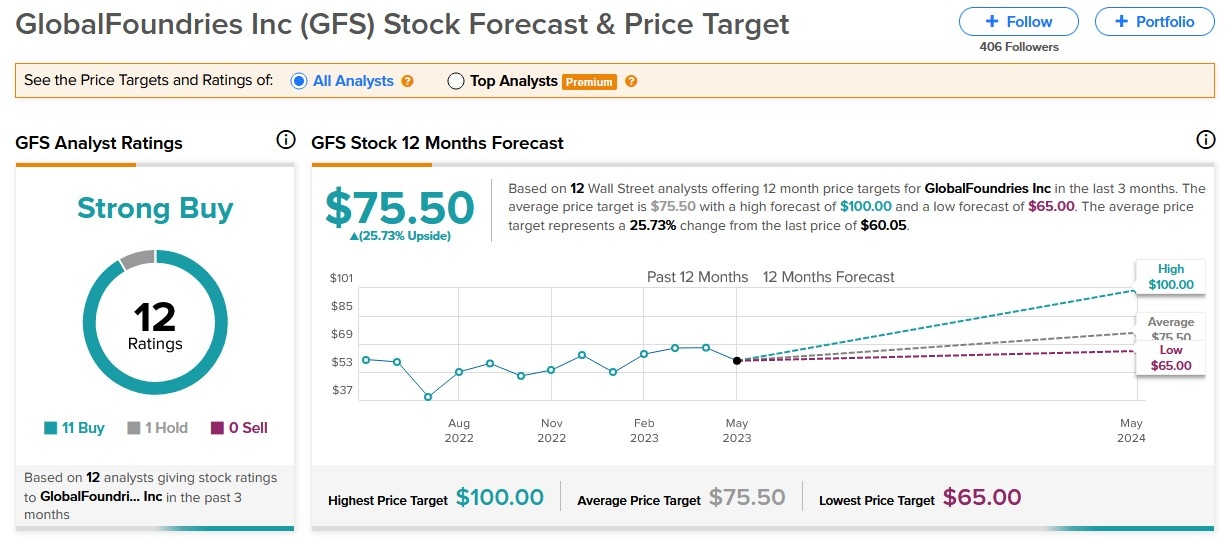

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....