Embarking on the journey of investing in the US stock market can be both exhilarating and daunting. Whether you're a novice looking to diversify your portfolio or simply curious about the stock market, understanding the basics is crucial. In this article, we'll delve into the fundamentals of the US stock market, helping you navigate this complex world with confidence.

Understanding the Stock Market

The stock market is a platform where shares of public companies are bought and sold. When you purchase a stock, you're essentially buying a small piece of that company. The value of your investment can increase or decrease based on the company's performance and market conditions.

Types of Stocks

There are several types of stocks to consider:

- Common Stocks: These represent ownership in a company and come with voting rights. They offer the potential for higher returns but come with higher risk.

- Preferred Stocks: These provide fixed dividends and have a higher claim on assets than common stocks. They are often considered less risky but offer lower potential returns.

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a history of consistent earnings and dividends.

How to Invest in the Stock Market

Investing in the stock market can be done through various platforms:

- Brokerage Accounts: These allow you to buy and sell stocks online. Popular brokerage firms include Charles Schwab, Fidelity, and TD Ameritrade.

- Robo-Advisors: These automated investment platforms offer low-cost investment management based on your risk tolerance and investment goals.

- Direct Stock Purchase Plans (DSPPs): These allow you to purchase shares directly from the company, often with lower fees than traditional brokerage accounts.

Understanding Market Indices

Market indices are a measure of the overall performance of the stock market. Some of the most well-known indices include:

- S&P 500: A measure of the performance of 500 large companies listed on the New York Stock Exchange and NASDAQ.

- Dow Jones Industrial Average (DJIA): A price-weighted average of 30 large publicly traded companies in the United States.

- NASDAQ Composite: A broad-based index representing all domestic and international common stocks listed on the NASDAQ stock exchange.

Risks and Rewards

Investing in the stock market comes with risks, including market volatility, economic downturns, and company-specific risks. However, the potential for high returns makes it an attractive option for long-term investors.

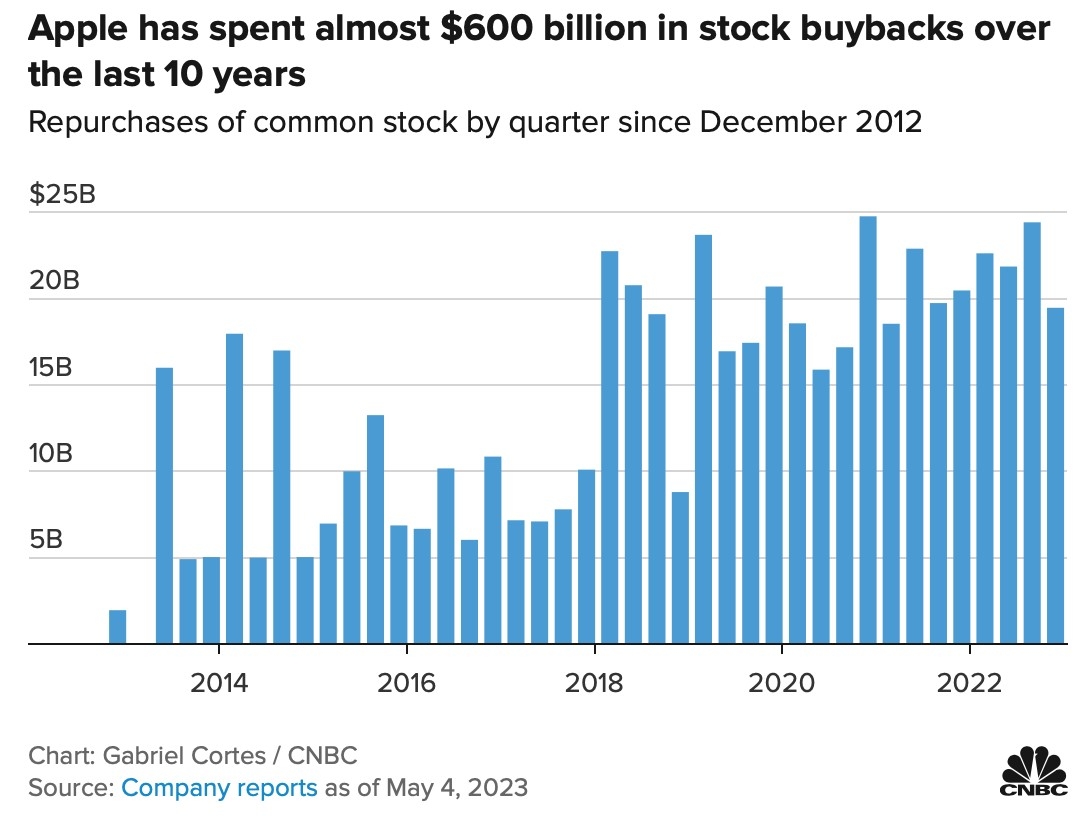

Case Study: Apple Inc.

Consider Apple Inc., one of the most successful companies in the world. If you had invested

Conclusion

Understanding the basics of the US stock market is essential for anyone looking to invest. By familiarizing yourself with different types of stocks, investment platforms, market indices, and risks, you'll be well-equipped to navigate this complex world with confidence. Remember, investing is a long-term endeavor, and patience and discipline are key to success.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....