In the global financial landscape, the US and China stock markets stand as two of the most influential and dynamic. This article provides a detailed comparison of these markets, highlighting key differences and similarities, and offering insights into their respective performance. By examining historical data, market structure, and investment trends, we aim to shed light on the unique characteristics of each market.

Market Performance

Historical Data

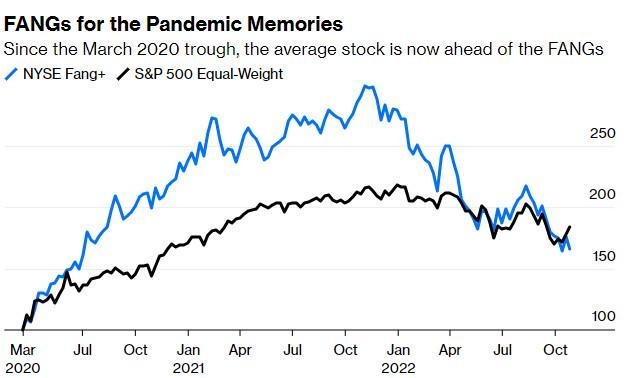

Over the past decade, the US stock market has demonstrated remarkable resilience and growth. The S&P 500 index, a widely followed benchmark, has seen a steady increase in value, with a few notable downturns during the 2008 financial crisis and the COVID-19 pandemic. In contrast, the Chinese stock market has experienced more volatility, with periods of rapid growth followed by significant corrections.

Market Structure

The US stock market is characterized by its diversity and depth. It encompasses a wide range of sectors, including technology, healthcare, and financial services. The NYSE and NASDAQ are the two primary exchanges, offering access to both large-cap and small-cap companies. The Chinese stock market, on the other hand, is dominated by state-owned enterprises and has a higher concentration of companies in sectors such as energy and telecommunications.

Investment Trends

US Stock Market

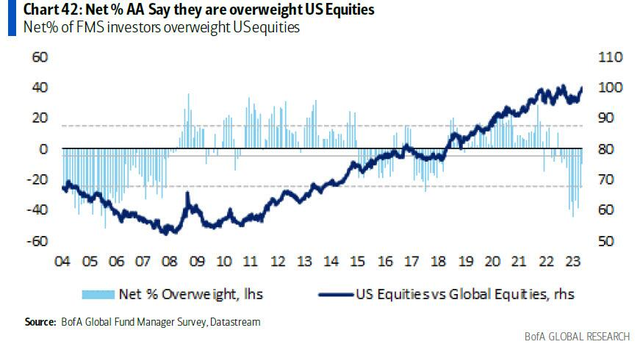

Investors in the US stock market tend to focus on long-term growth and dividend yields. The market offers a wide array of investment vehicles, including stocks, bonds, and ETFs. The rise of passive investing, particularly through index funds, has also become a significant trend in recent years.

Chinese Stock Market

Investors in the Chinese stock market are more inclined to engage in short-term trading and speculation. The market offers a higher level of risk, with more frequent price volatility. Additionally, the presence of a significant retail investor base contributes to the market's speculative nature.

Case Studies

To illustrate the differences between the US and Chinese stock markets, let's consider two companies: Apple Inc. (AAPL) and Tencent Holdings Ltd. (0700.HK).

Apple Inc. (AAPL)

Apple, a US-based technology company, has consistently delivered strong financial performance over the years. Its shares are listed on the NASDAQ exchange and are a component of the S&P 500 index. The company has a strong brand presence and a diversified product portfolio, making it a favorite among investors.

Tencent Holdings Ltd. (0700.HK)

Tencent, a Chinese internet and technology company, is one of the largest players in the Asian market. Its shares are listed on the Hong Kong Stock Exchange and are not part of any major global indices. The company operates in various sectors, including gaming, social media, and e-commerce, but has faced regulatory challenges in recent years.

Conclusion

The US and Chinese stock markets offer unique investment opportunities and challenges. Understanding the differences between these markets is crucial for investors looking to diversify their portfolios. By analyzing historical data, market structure, and investment trends, we can gain valuable insights into the strengths and weaknesses of each market. As the global financial landscape continues to evolve, staying informed about these markets is essential for successful investing.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....