In the ever-evolving global financial landscape, investors from India are increasingly looking towards the United States for investment opportunities. The allure of the American stock market, known for its robustness and diversity, is undeniable. However, the question of safety is paramount. This article delves into the safety aspects of investing in US stocks from India, providing insights into the risks and rewards involved.

Understanding the US Stock Market

The US stock market, home to iconic companies like Apple, Google, and Microsoft, is the largest and most liquid in the world. Its market capitalization surpasses that of other countries combined. Investing in US stocks offers several advantages:

- Diversification: The US market hosts a wide range of sectors and industries, allowing investors to diversify their portfolios.

- Strong Regulatory Framework: The US has a robust regulatory framework that ensures fair trading practices and protects investors.

- Economic Stability: The US economy is considered one of the most stable in the world, offering a safe haven for investors.

Risks Involved in Investing from India

While investing in US stocks from India offers numerous benefits, it also comes with certain risks:

- Currency Fluctuations: Exchange rate fluctuations can impact the returns on investments. A weaker rupee can increase the returns in Indian rupees.

- Regulatory Differences: Differences in regulatory frameworks between India and the US can pose challenges for investors.

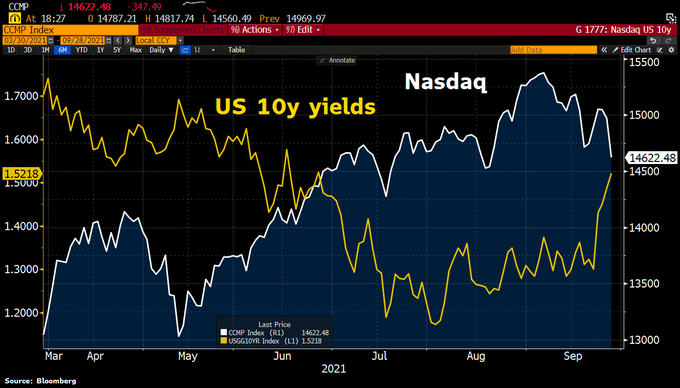

- Market Volatility: The US stock market can be volatile, leading to significant fluctuations in investment values.

How to Invest in US Stocks from India

Investing in US stocks from India is relatively straightforward. Here are the steps involved:

- Open a Foreign Currency Account: You need a foreign currency account to invest in US stocks. You can open an account with a bank that offers this service.

- Choose a Broker: Select a reliable and regulated broker that offers access to the US stock market. Many brokers offer online platforms that are easy to use.

- Complete the Registration Process: You will need to complete the registration process with the broker, providing necessary documents and details.

- Fund Your Account: Transfer funds from your Indian bank account to your foreign currency account.

- Invest in US Stocks: Once your account is funded, you can start investing in US stocks.

Case Study: Indian Investor in US Stocks

Consider the case of Mr. Sharma, an Indian investor who invested

Conclusion

Investing in US stocks from India can be a safe and profitable venture. While there are risks involved, understanding these risks and taking appropriate measures can help mitigate them. By diversifying your portfolio and choosing a reliable broker, you can capitalize on the opportunities offered by the US stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....