In the vast and dynamic world of investing, AMC stocks have emerged as a significant area of interest for many investors. But what exactly are AMC stocks, and how do they fit into the broader US market? This article delves into the intricacies of AMC stocks, providing a comprehensive overview of their role and significance in the American stock market.

What Are AMC Stocks?

AMC stocks refer to shares of companies listed on the American stock exchanges. These companies operate in a variety of industries, including technology, healthcare, finance, retail, and more. The term "AMC" stands for "American Market Center," which signifies that these stocks are traded on American exchanges.

Understanding the US Market Dynamics

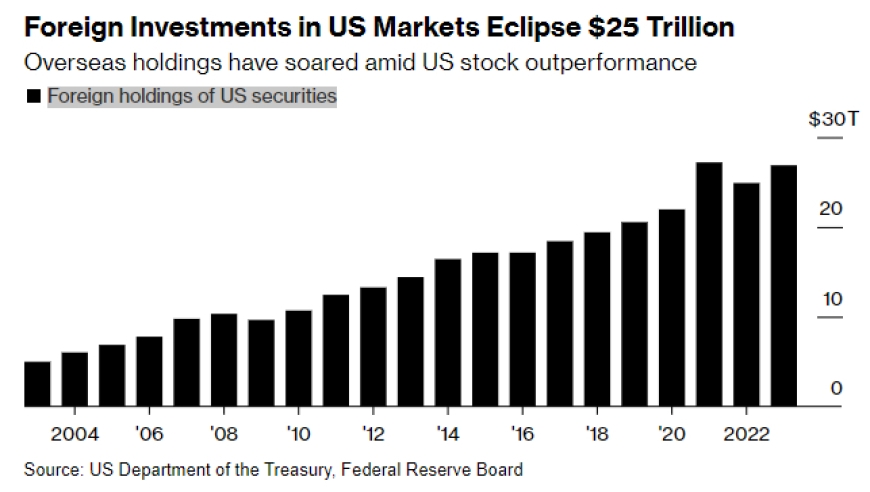

The US stock market is the largest and most liquid in the world, attracting investors from across the globe. It is characterized by a diverse range of stocks, from small-cap companies to large-cap giants. The market is also known for its high level of liquidity, which allows investors to buy and sell stocks with ease.

Key Factors Influencing AMC Stocks

Several factors influence the performance of AMC stocks in the US market. These include:

- Economic Conditions: The overall economic health of the country plays a crucial role in determining the performance of AMC stocks. Factors like GDP growth, unemployment rates, and inflation can significantly impact stock prices.

- Company Performance: The financial performance of individual companies, including revenue growth, profit margins, and earnings per share, are critical factors that influence stock prices.

- Market Sentiment: Investor sentiment can also play a significant role in driving stock prices. Factors like market trends, political events, and global economic developments can influence investor sentiment.

Case Study: AMC Entertainment Holdings, Inc.

AMC Entertainment Holdings, Inc. (AMC) is a prime example of an AMC stock. AMC is a leading global movie exhibition company with approximately 900 theatres in the United States, Canada, and internationally. The company's stock has experienced significant volatility over the years, reflecting the broader market dynamics.

One notable event was the COVID-19 pandemic, which caused a temporary shutdown of movie theaters worldwide. Despite this, AMC's stock managed to recover and even reached new highs in 2021, reflecting investor optimism about the company's future prospects.

Investing in AMC Stocks

Investing in AMC stocks can be a lucrative opportunity, but it requires thorough research and analysis. Here are some tips for investors considering AMC stocks:

- Research and Analysis: Conduct comprehensive research on the company and its industry. Analyze financial statements, market trends, and other relevant data to make informed investment decisions.

- Risk Management: Understand the risks associated with investing in AMC stocks. These can include market volatility, economic downturns, and company-specific risks.

- Diversification: Diversify your investment portfolio to reduce risk. Consider investing in a mix of AMC stocks, as well as other asset classes like bonds and real estate.

In conclusion, AMC stocks are an integral part of the US stock market, offering investors diverse opportunities for growth. By understanding the key factors influencing AMC stocks and conducting thorough research, investors can make informed decisions and potentially achieve significant returns.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....