In today's rapidly evolving financial landscape, understanding the currency markets is crucial for both investors and businesses. The currency markets, also known as forex or foreign exchange markets, are where global currencies are traded. This article delves into the key insights and trends dominating currency markets today, providing a comprehensive overview for those looking to stay ahead in the global financial arena.

Global Economic Landscape and Its Impact on Currency Markets

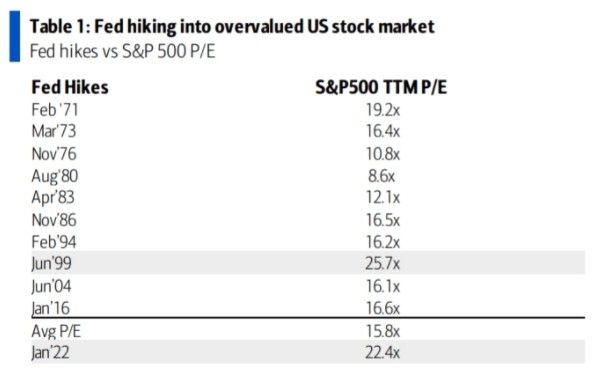

The global economic landscape continues to shape currency market trends. Factors such as political stability, interest rates, inflation rates, and economic growth play a significant role in determining the value of currencies. For instance, the US Dollar remains a major player, influenced by the Federal Reserve's monetary policy decisions.

US Dollar Strength and Weakness

Currently, the US Dollar is experiencing a period of strength. This is partly due to the Federal Reserve's tightening monetary policy, aimed at curbing inflation. However, this has also led to a weakness in other major currencies like the Euro and the Japanese Yen.

Eurozone Challenges

The Eurozone faces several challenges, including political uncertainties and economic instability. These factors have contributed to the weakening of the Euro against the US Dollar. Investors are closely monitoring developments in the Eurozone, as they could impact the currency's future performance.

Emerging Markets and Currency Volatility

Emerging markets have been a significant source of currency volatility. Currencies like the Brazilian Real and the South African Rand are subject to rapid movements due to various factors, including commodity prices, political events, and economic policies.

Impact of Technology and Automation

Technology has revolutionized the currency markets. The advent of algorithmic trading and robotic advisors has made the forex market more accessible and efficient. These advancements have also increased the speed and volume of currency transactions.

Case Study: Brexit and the British Pound

A notable case study in recent years is the Brexit referendum and its impact on the British Pound. Following the vote to leave the European Union, the British Pound experienced a significant devaluation. However, it has since stabilized, highlighting the resilience of the currency.

Conclusion: Staying Informed

In conclusion, staying informed about the currency markets today is essential for anyone involved in global finance. Understanding the key trends and factors that influence currency values can help investors and businesses make informed decisions. By keeping a close eye on global economic indicators, political developments, and technological advancements, one can navigate the complexities of the currency markets with greater confidence.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....