The Dow Jones Industrial Average (DJIA) has been a staple in the financial world for over a century. However, as of today, it's down. But why? Let's dive into the reasons behind the Dow's recent downturn.

Economic Indicators and Market Sentiment

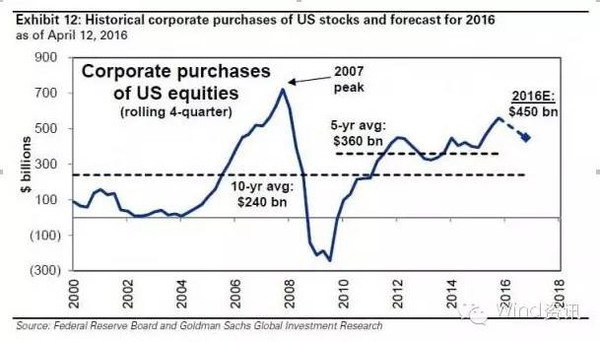

One of the primary reasons for the Dow's decline today is economic indicators and market sentiment. Recent data has shown that the U.S. economy is facing challenges, such as rising inflation and slowing GDP growth. These indicators have caused investors to become increasingly cautious, leading to a sell-off in the stock market.

Rising Inflation and Interest Rates

Rising inflation has been a major concern for investors recently. The Federal Reserve has been raising interest rates to combat inflation, but this has also led to higher borrowing costs for companies and consumers. As a result, many investors are concerned about the potential impact of higher interest rates on the economy and the stock market.

Global Economic Factors

The global economy is also playing a role in the Dow's decline. Geopolitical tensions and supply chain disruptions have caused uncertainty in the market. Additionally, the weak performance of major economies, such as China and the Eurozone, has also contributed to the Dow's downward trend.

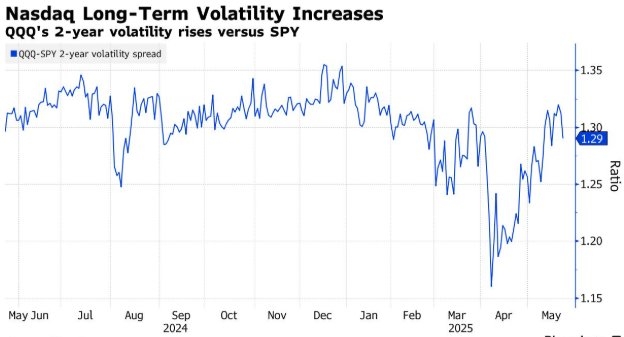

Sector-Specific Factors

Sector-specific factors have also been impacting the Dow. For example, the technology sector, which has been a major driver of the market's growth over the past few years, has seen a significant downturn. This has had a ripple effect on the broader market, leading to the Dow's decline.

Case Study: Tech Giant

A prime example of this is the recent downturn in the stock of a major tech company. The company, which has been a leading player in the industry, announced disappointing earnings and guidance. This led to a significant sell-off in the company's stock, which in turn had a negative impact on the Dow.

Conclusion

In conclusion, the Dow's recent decline can be attributed to a combination of economic indicators, rising inflation and interest rates, global economic factors, and sector-specific issues. As investors continue to navigate this uncertain market, it's important to stay informed and make well-informed decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....