Understanding the Interconnectedness of Global Markets

In the era of globalization, the financial markets are more interconnected than ever before. A market crash in one country can have ripple effects across the globe, including on international stocks. The question on many investors' minds is whether a US stock market crash would impact international stocks. This article delves into this question, analyzing the interconnectedness of global markets and the potential consequences of a US stock market crash.

The Interconnectedness of Global Markets

Globalization has made it possible for companies to operate in multiple countries, and this has increased the interconnectedness of financial markets. The US stock market, being one of the largest and most influential in the world, can have a significant impact on other markets.

Direct Impact on International Stocks

When the US stock market crashes, it can directly impact international stocks in several ways:

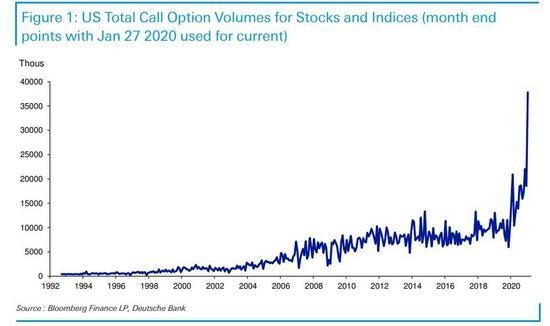

Market Sentiment: A crash in the US stock market can lead to a negative sentiment across global markets. Investors may become more risk-averse, leading to a sell-off in international stocks.

Currency Fluctuations: A US stock market crash can lead to a devaluation of the US dollar. This, in turn, can make international stocks more expensive for US investors, potentially leading to a sell-off.

Economic Indicators: A US stock market crash can be a sign of underlying economic problems in the US. This can lead to a decrease in investor confidence in other countries, impacting their stock markets as well.

Indirect Impact on International Stocks

The impact of a US stock market crash on international stocks can also be indirect:

Commodities: The US is a major consumer of commodities, such as oil and gold. A US stock market crash can lead to a decrease in demand for these commodities, impacting the economies of countries that rely on these exports.

Corporate Profits: Many international companies have significant operations in the US. A US stock market crash can lead to a decrease in their profits, impacting their stock prices.

Case Studies

One of the most significant examples of a US stock market crash impacting international stocks is the 2008 financial crisis. The crash in the US stock market led to a global financial crisis, with many international stocks experiencing significant declines.

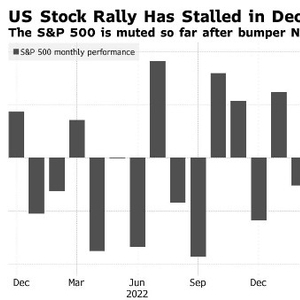

Another example is the tech stock crash of 2022. While this crash started in the US, it quickly spread to other markets, including Europe and Asia, leading to a widespread sell-off.

Conclusion

In conclusion, a US stock market crash can have a significant impact on international stocks. The interconnectedness of global markets means that a crash in the US can lead to a ripple effect across the globe. Investors should be aware of these potential risks and consider diversifying their portfolios to mitigate the impact of a US stock market crash.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....