In today's interconnected global market, the US dollar's decline has become a significant topic of discussion among investors. This article delves into the impact of the US dollar's depreciation on international stocks, highlighting the potential risks and opportunities it presents.

Understanding the USD Decline

The US dollar has been on a steady decline in recent years, influenced by various factors such as economic policies, trade tensions, and global demand. This depreciation has raised concerns among investors, particularly those with exposure to international stocks.

Impact on International Stocks

The decline in the US dollar has several implications for international stocks:

- Increased Purchasing Power: When the US dollar weakens, the purchasing power of investors holding international stocks increases. This means that investors can buy more shares of foreign companies with the same amount of USD.

- Potential for Higher Returns: As the value of the USD decreases, the returns on international stocks may become more attractive. This is particularly true for companies with strong fundamentals and growth prospects.

- Currency Risk: While the depreciation of the USD can lead to increased purchasing power, it also introduces currency risk. Investors may face challenges when converting their investments back to USD, potentially leading to losses.

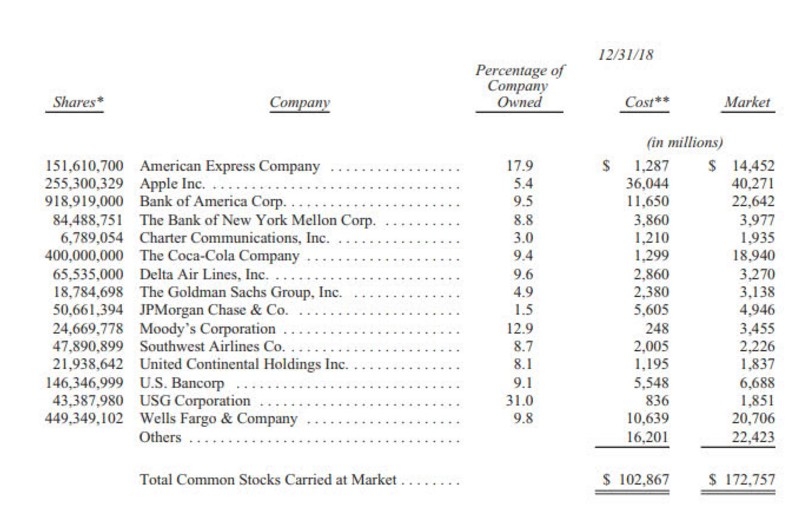

Case Study: Apple Inc.

A prime example of the impact of the USD decline on international stocks is Apple Inc. As the US dollar weakened, the value of Apple's shares in foreign currencies increased, leading to higher returns for investors. However, investors also faced the risk of currency fluctuations when converting their investments back to USD.

Strategies for Navigating the USD Decline

To navigate the challenges posed by the USD decline, investors can consider the following strategies:

- Diversification: Diversifying your portfolio across different currencies and asset classes can help mitigate the impact of currency fluctuations.

- Focus on Strong Fundamentals: Investing in companies with strong fundamentals and growth prospects can help offset the potential risks associated with currency fluctuations.

- Monitor Economic Indicators: Keeping a close eye on economic indicators can help you make informed decisions about your investments.

Conclusion

The US dollar's decline has become a significant factor in the global market, impacting international stocks in various ways. While it presents challenges, it also offers opportunities for investors. By understanding the implications and adopting appropriate strategies, investors can navigate the USD decline and achieve their investment goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....