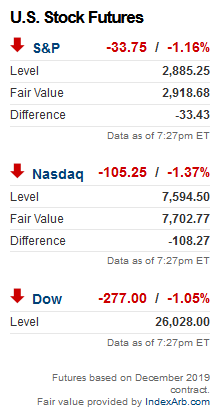

The US stock market has experienced a significant downturn in recent weeks, raising concerns among investors and financial analysts alike. This article delves into the reasons behind the fall and examines the potential implications for the economy and investors.

Market Dynamics and Economic Factors

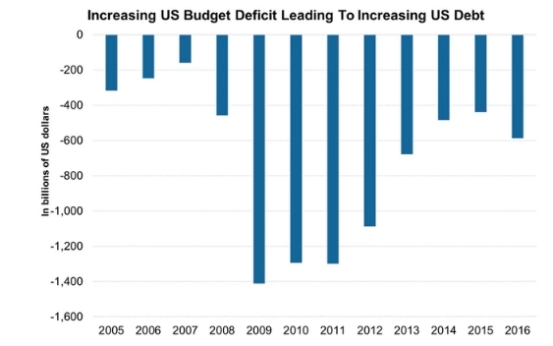

Several factors have contributed to the recent decline in the US stock market. One of the primary reasons is the inflation concerns. As the economy recovers from the COVID-19 pandemic, there has been a surge in demand, leading to higher prices for goods and services. The Federal Reserve has responded by increasing interest rates, which can lead to higher borrowing costs and slower economic growth.

Another factor is the geopolitical tensions. The ongoing conflict in Eastern Europe and the tensions between the US and China have created uncertainty in the global market. Investors often react negatively to such events, leading to a sell-off in stocks.

Sector-Specific Impacts

The decline in the stock market has not been uniform across all sectors. Some sectors, such as technology and consumer discretionary, have been particularly hard hit. This is due to the fact that these sectors are highly sensitive to economic cycles and consumer spending.

For example, Apple Inc., one of the largest technology companies in the world, has seen its stock price fall by nearly 20% in the past few months. This decline can be attributed to a combination of factors, including inflation concerns and geopolitical tensions.

On the other hand, utility and healthcare sectors have been relatively resilient. This is because these sectors are considered defensive and tend to perform well during times of economic uncertainty.

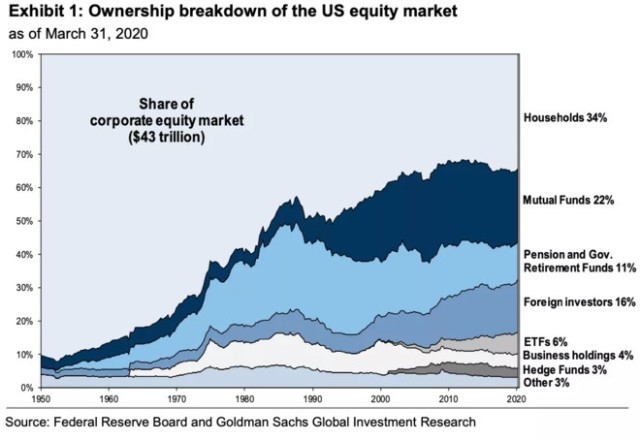

Investor Sentiment and Market Psychology

The recent fall in the stock market has also been influenced by investor sentiment. As the market becomes more volatile, investors often become more risk-averse, leading to a sell-off in stocks.

One example of this is the January 2022 market sell-off, which was triggered by concerns about the Omicron variant of COVID-19. The S&P 500 index fell by nearly 10% in just a few days, showcasing the power of investor sentiment on the market.

Case Study: Tesla, Inc.

A notable case study of the recent market decline is the stock of Tesla, Inc.. The electric vehicle manufacturer's stock has fallen by nearly 30% in the past few months. This decline can be attributed to a combination of factors, including inflation concerns and regulatory challenges.

Tesla has also faced production issues at its factories, which have impacted its ability to meet demand. These challenges have led to concerns about the company's long-term growth prospects, contributing to the stock's decline.

Conclusion

The recent fall in the US stock market is a complex issue with multiple contributing factors. Understanding these factors is crucial for investors looking to navigate the current market environment. As the economy continues to recover from the COVID-19 pandemic, it is important to remain vigilant and stay informed about the latest market developments.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....