In today's volatile financial landscape, diversifying a portfolio is crucial for long-term investment success. One of the most effective ways to achieve this is by including U.S. stocks. This article explores how U.S. stocks can enhance portfolio diversity and why they are a valuable asset class for investors.

Understanding Diversification

Diversification is the process of spreading your investments across various asset classes, industries, and geographic regions to reduce risk. The idea is that when one investment performs poorly, another may do well, balancing out your overall returns.

The Role of U.S. Stocks in Diversification

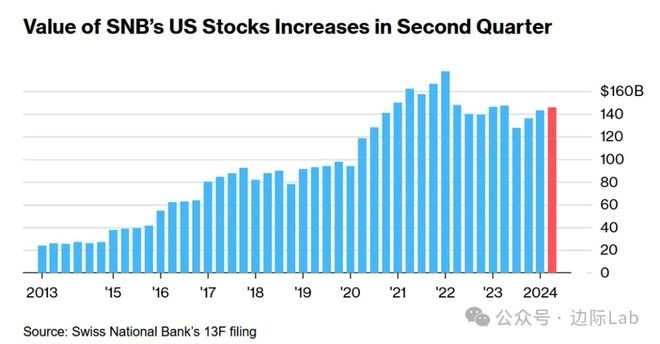

1. Exposure to a Large Market

The U.S. stock market is the largest and most liquid in the world, offering exposure to a wide range of companies across various industries. This means investors can gain access to companies that are leaders in their fields, from technology giants to consumer goods, financial services, and more.

2. Potential for High Returns

Historically, U.S. stocks have provided higher returns than many other investment vehicles. While no investment is guaranteed, U.S. stocks have often been a solid performer, especially over the long term.

3. Diversification Across Industries

Investing in a mix of U.S. stocks allows investors to diversify across different industries. For example, if one industry is hit by a downturn, others may remain strong, providing a buffer against market volatility.

4. Access to Global Companies

While U.S. stocks are domestic, many of them are global leaders. This means they have a significant international presence, which can protect against economic downturns in any one region.

Strategies for Diversifying with U.S. Stocks

1. Index Funds and ETFs

Investing in index funds or exchange-traded funds (ETFs) is a simple and cost-effective way to gain exposure to a broad range of U.S. stocks. These funds track a specific index, such as the S&P 500, which represents the top 500 companies listed on U.S. exchanges.

2. Sector Rotation

Sector rotation involves shifting investments between different sectors based on market conditions. For example, during a technology boom, technology stocks may outperform, while during a low-interest-rate environment, financial stocks may be more attractive.

3. Blue-Chip Stocks

Blue-chip stocks are shares of well-established companies with a history of stable earnings and dividends. Investing in blue-chip stocks can provide a level of security and income, which can be beneficial for diversification.

Case Studies

1. Technology Stocks in the 1990s

During the 1990s, technology stocks soared, leading the bull market. Investors who diversified their portfolios with U.S. tech stocks experienced significant returns, despite the volatility in other sectors.

2. Financial Crisis of 2008

The financial crisis of 2008 highlighted the importance of diversification. While financial stocks plummeted, other sectors like healthcare and consumer goods held up better, demonstrating the benefits of diversifying within the U.S. stock market.

Conclusion

Incorporating U.S. stocks into a diversified portfolio can provide a solid foundation for long-term investment success. By understanding the various ways U.S. stocks can enhance diversification, investors can make informed decisions that align with their financial goals and risk tolerance.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....