In the fast-paced world of finance, staying informed about the factors that influence the market is crucial for investors and traders. Today, we delve into the key elements shaping the market landscape. From geopolitical tensions to economic indicators, we'll explore what's currently moving the market.

Geopolitical Tensions and Global Events

One of the most significant factors impacting the market today is geopolitical tensions. The ongoing conflict in Eastern Europe has raised concerns about energy prices and supply chains. As a result, investors are closely monitoring the situation, leading to volatility in various markets.

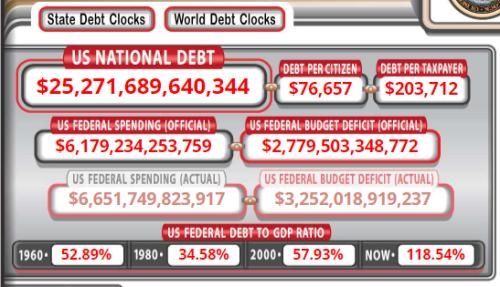

Economic Indicators and Central Bank Policies

Economic indicators play a vital role in shaping market trends. For instance, the latest jobs report from the United States revealed strong employment growth, which bolstered investor confidence. Additionally, central bank policies, particularly those of the Federal Reserve, are closely watched. The Fed's decision to raise interest rates has had a notable impact on the bond market and other asset classes.

Technological Advancements and Innovation

Technological advancements continue to drive market movements. The rise of artificial intelligence, blockchain, and cryptocurrencies has captured the attention of investors. Companies at the forefront of these technologies are experiencing significant growth, influencing market trends.

Corporate Earnings and Stock Valuations

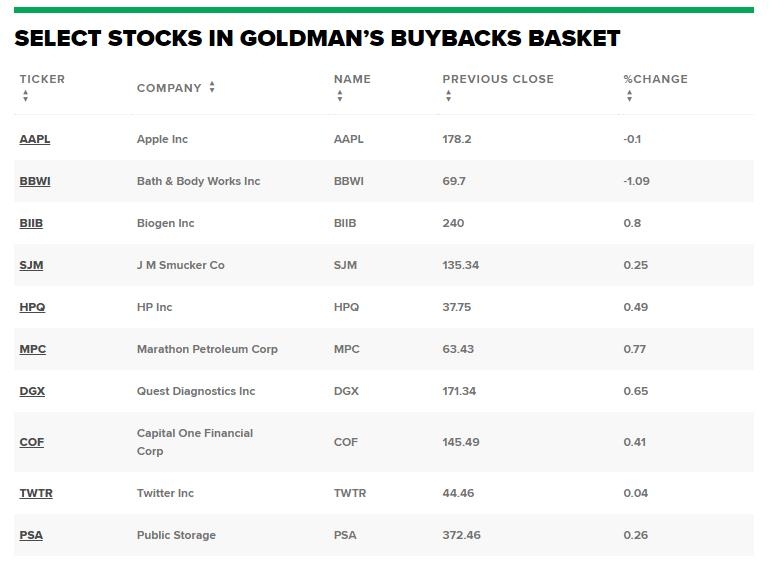

Corporate earnings reports are another critical factor influencing the market. Companies that exceed earnings expectations tend to see their stock prices rise, while those that miss expectations may experience a downturn. Additionally, stock valuations play a crucial role in determining market movements. Investors are closely analyzing the price-to-earnings (P/E) ratios of various sectors to identify undervalued or overvalued stocks.

Market Sentiment and Investor Psychology

Market sentiment and investor psychology cannot be overlooked. The mood of investors can quickly shift based on news, rumors, and economic events. For example, a positive sentiment can lead to a bull market, while a negative sentiment can trigger a bear market.

Case Studies: Tech Giants and Energy Sector

To illustrate the impact of these factors, let's consider a few case studies. Apple Inc., a leading technology company, has seen its stock price soar due to strong earnings reports and the increasing demand for its products. Conversely, the energy sector has been affected by geopolitical tensions, with oil prices fluctuating significantly.

Conclusion

In conclusion, several factors are currently moving the market. From geopolitical tensions to economic indicators and technological advancements, investors must stay informed to make informed decisions. By understanding these key elements, one can better navigate the complex market landscape and identify potential opportunities.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....